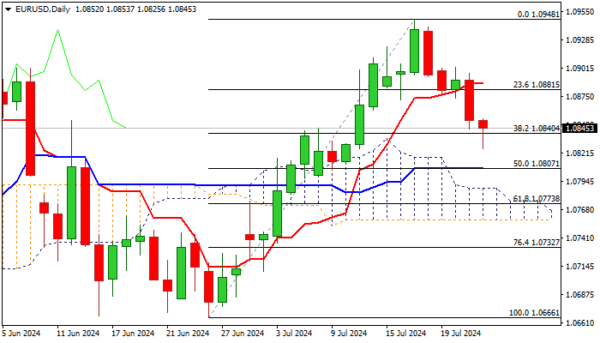

EURUSD extended pullback from a multi-month high (1.0948) and cracked pivotal supports at 1.0840/33 (Fibo 38.2% of 1.0666/1.0948 / 20DMA) but struggling to make a clear break lower.

Oversold conditions on daily chart provided headwinds, suggesting that bears may take a breather, as markets await release of US July PMI data, due later today.

Traders also focus on US Q2 GDP (due on Thursday) and June PCE (Friday) for more details about the condition of the economy and inflation, the key factors to Fed’s decision about the start of rate cutting cycle.

Limited recovery should provide better selling opportunities for extension towards 1.0807/00 (daily Kijun-sen / psychological) and 1.0788 (top of thinning daily cloud).

Only lift and close above daily Tenkan-sen (1.0886) to sideline bears on completion of bear-trap and reversal signal.

Res: 1.0861; 1.0886; 1.0902; 1.0948.

Sup: 1.0840; 1.0825; 1.0807; 1.0788.