The Bank of Canada has delivered what it suggested could be the last hike for its current cycle, raising the overnight rate by 25 basis points to 4.5%. Will the U.S. Fed follow suit next week?

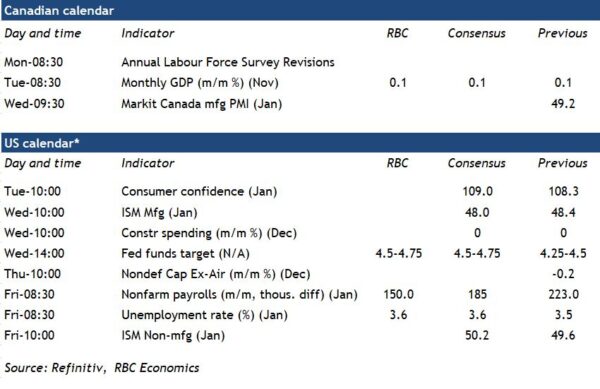

We do expect the size of its rate increase to mirror the BoC’s at 25 basis points. That’s half the size of its December hike and would take the fed funds target range to 4.5% to 4.75%. Price pressures in the U.S. have shown encouraging signs of slowing. Headline CPI growth rates have eased and the breadth of price pressures has narrowed alongside lower gasoline prices, easing global supply chain constraints, and slower economic growth momentum. Manufacturing sales for consumer goods fell by over 3% by late 2022 from peak levels in June. Consumer spending volumes declined two consecutive months over November and December.

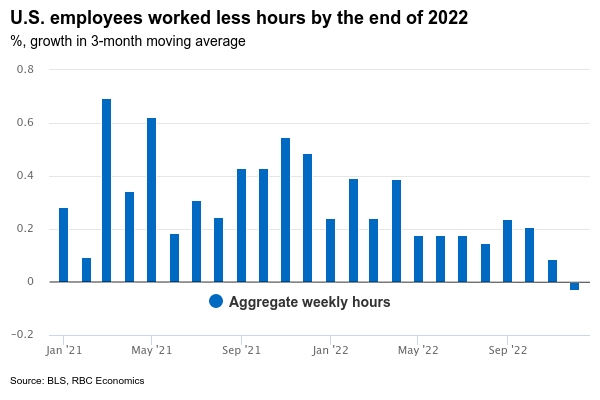

Labour markets are still running hot with the U.S. unemployment rate matching multi-decade lows at 3.5% in December. But, over the last three months, total hours worked declined for the first time since the 2020 pandemic lockdowns—in line with expectations that reduced hours would come before layoffs. Wage growth is still high but has been edging lower. And further softening in labour demand is likely as the impact of 425 basis points of hikes last year (the most aggressive hiking cycle since the 1980s) continues to work its way through the economy. In December, most Federal Open Market Committee participants expected that the fed funds target range would need to be lifted above 5% this year. But we expect a pause in the slightly lower range of 4.75% to 5%—provided ongoing softening in U.S. inflation and growth trends persists.

Week ahead data watch

We expect Canadian GDP to tick up 0.1% in November, in line with StatCan’s advance estimate. Construction, retail, mining, quarrying, and oil and gas extraction declines partially offset increases in manufacturing, utilities, wholesale, and finance and insurance. Growth has slowed over the fall and early winter following stronger gains over the summer. We also look for December output to be little changed with hours worked up 0.1% in the month.

U.S. payroll employment likely continued to rise in January, although the 150,000 increase in payrolls we expect would be the smallest gain since a drop in December 2020. The labour market remains tight and layoffs are still very low. But the number of job openings has been edging lower and we look for a tick up in the unemployment rate to 3.6% from 3.5% in December.

Revisions to closely-watched Canadian labour market data will be released next Monday. Re-estimated seasonal factors and implementation of a new classification by occupation are not expected to have a significant impact on annual estimates of employment for 2022, although could change the monthly pattern of growth within the year and recent trends.