EUR/JPY – 134.34

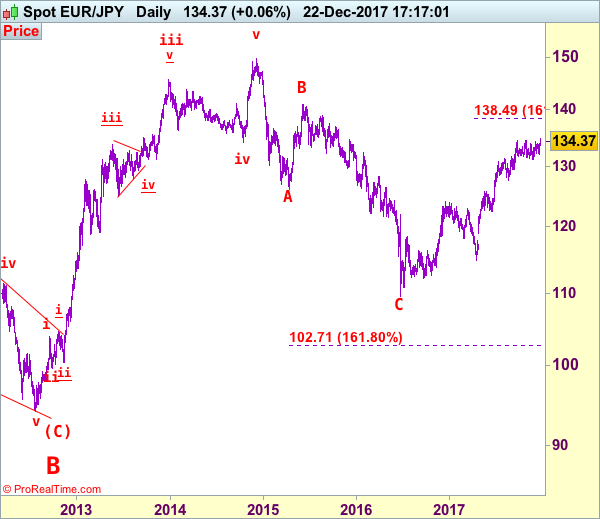

The single currency found renewed buying interest at 132.05 last week and has rallied above indicated previous resistance at 134.50, confirming medium term upmove has resumed and may extend further gain to 135.00-10, then 135.50-60, however, near term overbought condition should prevent sharp move beyond 136.00-10 and price should falter below 136.90-00, the pair should falter well below 138.45-50 (1.618 times extension of 109.49-124.10 measuring from 114.85), risk from there is seen for a major correction to take place in 2018.

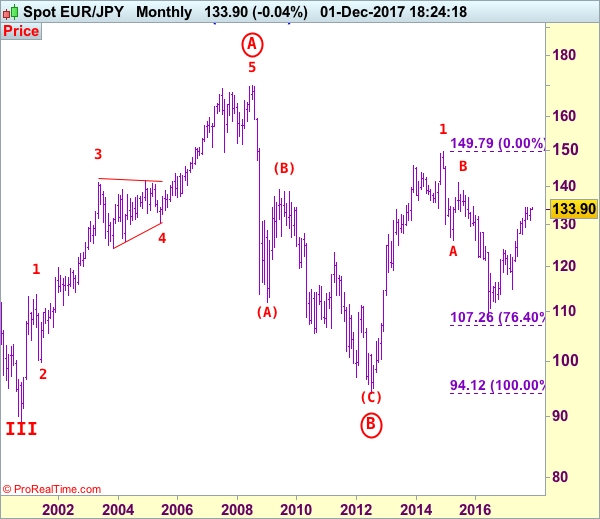

The daily chart is labeled as attached, early selloff from 169.97 (July 2008) to 112.08 is wave (A) of B instead of end of entire wave B and then the rebound from there to 139.26 is wave (B), hence, wave (C) has possibly ended at 94.12 with a diagonal triangle as labeled in the daily chart, hence upside bias is seen for further gain. Recent rally above indicated retracement level at 116.69 (50% Fibonacci retracement of the intermediate fall from 139.26-94.12) adds credence to this view and signal major reversal has commenced but first leg of this wave C has possibly ended at 149.79, hence wave 2 has commenced with wave A ended at 126.09, followed by wave B at 141.06, wave C commenced and could have ended at 109.49, indicated upside targets at 126.00 and 130.00 had been met and further gain to 135.00 would follow.

On the downside, whilst pullback to 133.85-90 cannot be rued out, reckon 133.50 would limit downside and bring another rise later to aforesaid upside targets. Only a drop below previous minor resistance at 133.01 would defer and suggest top is possibly formed, bring weakness to 132.50 but said support at 132.05 should remain intact. Looking ahead, if euro drops below said support at 132.05, this would signal a temporary top is formed instead, bring retracement of recent rise to 131.50, then test of previous support at 131.17 which is likely to hold from here.

Recommendation: FINAL UPDATE, HOPE TO SEE U ALL SOON.

To re-cap the corrective upmove from the record low of 88.93 (18 Oct 2000), the wave A from there is subdivided as: 1:88.93-113.72, 2:99.88 (1 Jun 2001), 3:140.91 (30 May 2003), 4:124.17 (10 Nov 2003) and 5 ended at record high of 169.97 (21 Jul 2008). The brief but sharp selloff to 112.08 is viewed as a-b-c x a-b-c wave (A) of B. The subsequent rebound to 139.26 is (B) of B and (C) of (B) has possibly ended at 94.12 and in any case price should stay well above previous chart support at 88.93, bring rally in larger degree wave C towards 150.00.