EUR/JPY – 132.12

Although the single currency fell marginally to 131.40 earlier this week, lack of follow through selling suggests consolidation would be seen and recovery to 133.00-10 cannot be ruled out, however, if our view that a temporary top formed at 134.50 is correct, upside should be limited to 133.50-60 and bring another decline, below said support at 131.40 would bring retracement of recent upmove to 131.00, then towards another previous support at 130.62, having said that, reckon 130.00 would hold from here, bring rebound later.

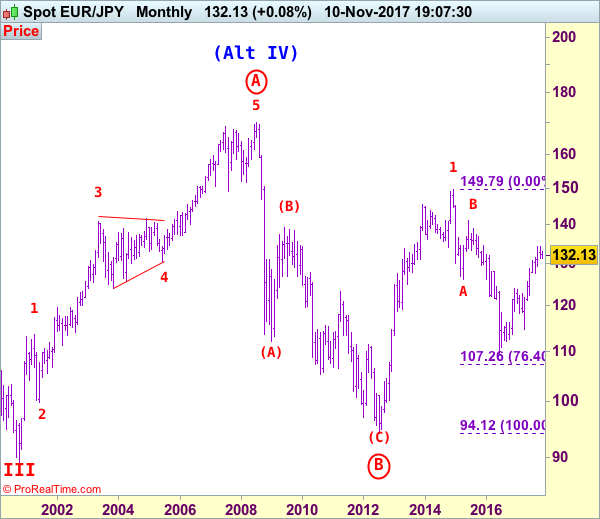

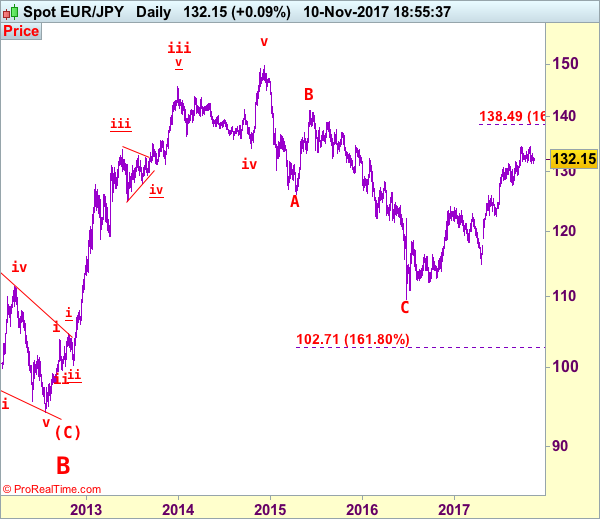

The daily chart is labeled as attached, early selloff from 169.97 (July 2008) to 112.08 is wave (A) of B instead of end of entire wave B and then the rebound from there to 139.26 is wave (B), hence, wave (C) has possibly ended at 94.12 with a diagonal triangle as labeled in the daily chart, hence upside bias is seen for further gain. Recent rally above indicated retracement level at 116.69 (50% Fibonacci retracement of the intermediate fall from 139.26-94.12) adds credence to this view and signal major reversal has commenced but first leg of this wave C has possibly ended at 149.79, hence wave 2 has commenced with wave A ended at 126.09, followed by wave B at 141.06, wave C commenced and could have ended at 109.49, indicated upside targets at 126.00 and 130.00 had been met and further gain to 135.00 would follow.

On the upside, whilst initial recovery to 133.50-60 cannot be ruled out, reckon 134.00 would hold and bring another retreat. Only break of said resistance at 134.50 would abort and signal recent upmove has resumed and extend further gain to 135.00, however, loss of upward momentum should prevent sharp move beyond 136.00-10 and reckon 136.95-00 would hold, price should falter well below 138.45-50 (1.618 times extension of 109.49-124.10 measuring from 114.85), bring correction later.

Recommendation: Sell at 133.50 for 131.50 with stop below 134.50.

To re-cap the corrective upmove from the record low of 88.93 (18 Oct 2000), the wave A from there is subdivided as: 1:88.93-113.72, 2:99.88 (1 Jun 2001), 3:140.91 (30 May 2003), 4:124.17 (10 Nov 2003) and 5 ended at record high of 169.97 (21 Jul 2008). The brief but sharp selloff to 112.08 is viewed as a-b-c x a-b-c wave (A) of B. The subsequent rebound to 139.26 is (B) of B and (C) of (B) has possibly ended at 94.12 and in any case price should stay well above previous chart support at 88.93, bring rally in larger degree wave C towards 150.00.