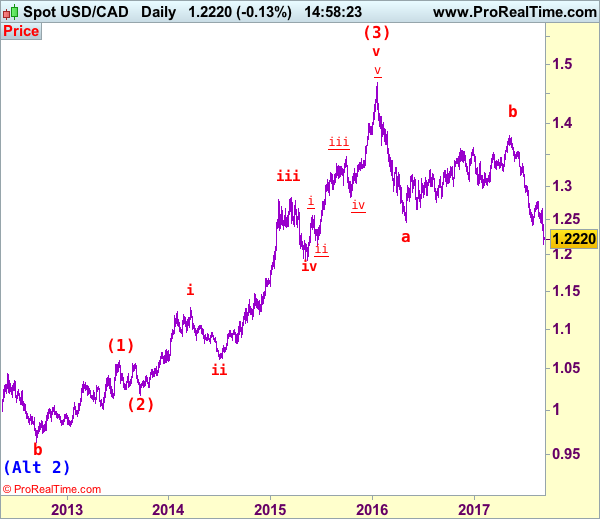

USD/CAD – 1.2215

The greenback finally resumed recent decline after last week’s brief bounce to 1.2663, justifying our bearish count for recent decline to resume in minor wave v of wave C, our short position entered at 1.2650 met downside target at 1.2450 with 200 points profit, this anticipated selloff has reinforced our bearishness for current wave C to extend further fall to 1.2140, then towards 1.2100, however, loss of momentum should prevent sharp fall below psychological support at 1.2000, bring rebound later. We are keeping our bearish count that wave b ended at 1.3794 and wave c has commenced for further fall to aforesaid downside targets.

We are keeping our view that the wave b from 1.0657 (a leg top) has possibly ended at 0.9633 with (a): 0.9800, wave (b): 1.0447 and wave c at 0.9633, the subsequent rise from there is now treated as wave c exceeded indicated upside target at 1.3770-80 and 1.4000 and wave (3) has possibly ended at 1.4690 and wave (4) correction has commenced for retracement back to 1.2410-20, then towards 1.2200.

On the daily chart, our latest preferred count remains that the A of (B) rally from 0.9059 low (7 Nov 2007) unfolded into an impulsive wave with i: 0.9059-1.0380, ii ended at 0.9819, iii at 1.3019 followed by triangle wave iv at 1.2026 , then wave v formed a top at 1.3066 and also ended the wave A. The wave B is unfolding as an double three a-b-c-x-a-b-c and is sub-divided as a: 1.2192, b: 1.2716 and wave c at 1.0784, followed by wave x at 1.1725, another set of a-b-c unfolded with 2nd a at 0.9931, 2nd b at 1.0674. the 2nd c has possibly ended at 0.9407, therefore, consolidation with upside bias is seen for major correction, indicated target at 1.3900 had been met and gain to 1.4700 would follow.

On the upside, whilst initial recovery to 1.2290-00 cannot be ruled out, reckon upside would be limited to 1.2350-60 and price should falter below previous support at 1.2414 (now resistance), bring another decline later. A daily close above 1.2440-50 would defer and suggest a temporary low is possibly formed, bring a stronger rebound to 1.2500 and possibly 1.2550-60 but said resistance at 1.2663 should remain intact.

Recommendation: Short entered at 1.2650 met target at 1.2450 with 200 points profit and would be prudent to stand aside for this week.

Longer term – The selloff from 1.6194 (21 Jan 2002) to 0.9059 (07 Nov 2007) is viewed as (A) wave which is a 5-waver as labeled on the monthly chart as below, the subsequently rally is labeled as (B) with impulsive A leg of (B) ended at 1.3066, wave B of (B) is unfolding which has either ended at 0.9407 or would extend one more fall but downside should be limited to 0.9200 and 0.9000 should hold.