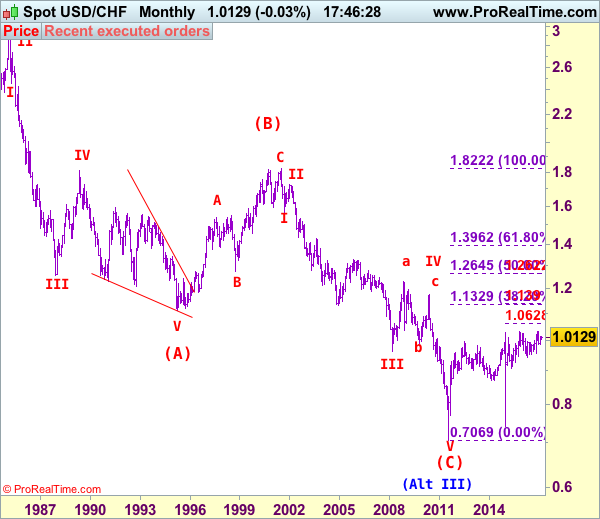

USD/CHF – 1.0125

USD/CHF – Wave IV ended at 1.1730 and wave V has possibly ended at 0.7068

As the greenback has continued trading with a firm undertone after rising from 1.0009 (last week’s low), adding credence to our bullish view that the erratic rise from 0.9861 is still in progress and may extend further gain to 1.0200 and possibly test of resistance at 1.0248, however, a daily close above there is needed to signal the retreat from 1.0344 has ended at 0.9861, bring eventual retest of 1.0344. Looking ahead, only break of said resistance at 1.0344 would retain bullishness and extend the major rise from 0.7401 (2015 low) to 1.0400 and later towards 1.0470-75 but upside should be limited to 1.0500 and price should falter below 1.0600.

Our preferred count on the daily chart is that early selloff to 0.9630 is an end of the larger degree wave III and major correction is unfolding from there with a leg ended at 1.2298 (Nov 2008 with (a): 1.0625, (b):1.0011 and (c):1.2298), wave b ended at 0.9910 with (a): 1.0370, (b): 1.1967, (c): 0.9910. The rise from there to 1.1730 is the wave c which also marked the end of wave IV and wave V has possibly ended at 0.7068.

On the downside, whilst initial pullback to 1.0065-70 cannot be ruled out, reckon said support at 1.0009 would remain intact and bring another rise later to aforesaid upside targets. A daily close below support at 1.0009 would abort and suggest the rebound from 0.9861 has possibly ended, bring test of 0.9967, break there would add credence to this view and bring further fall to 0.9900. A drop below there would confirm and signal the fall from 1.0344 has resumed for a retest of said support at 0.9861, once this level is penetrated, this would extend this decline to 0.9850-53 (61.8% Fibonacci retracement of 0.9550-1.0344), then 0.9800, having said that, reckon downside would be limited to 0.9735-40 and 0.9675-80 should hold from here, bring rebound later..

Recommendation: Buy at 1.0065 for 1.0265 with stop below 0.9965.

Dollar’s long-term downtrend started from 2.9343 (Feb 1995) and it was unfolding as a (A)-(B)-(C) with (A): 1.1100, (B): 1.8310 (26 Oct 2000), then followed by another impulsive wave (C) with wave III ended at 0.9630 (Mar 2008). Under this count, correction in wave IV has possibly ended at 1.1730 and wave V already broke below support at 0.9630 and met indicated downside target at 0.7500 and 0.7400. The reversal from 0.7068 suggests the wave V has possibly ended and the breach of resistance at 0.9595 add credence to this view and indicated upside target at 1.0000 had been met, however, the sharp retreat from 1.0296 to 0.7401 suggests choppy trading would be seen but price should stay above said record low at 0.7068.