EUR/GBP – 0.9089

As the single currency has risen again brief pullback, suggesting recent erratic rise from 0.8304 (Dec 2016) is still in progress and bullishness remains for this move to extend gain to 0.9190-00, then towards 0.9250-60, however, overbought condition should prevent sharp move beyond 0.9300 and reckon 0.9380-85 (100% projection of 0.8312-0.8950 measuring from 0.8743) would hold from here, risk from there is seen for a retreat due to near term overbought condition.

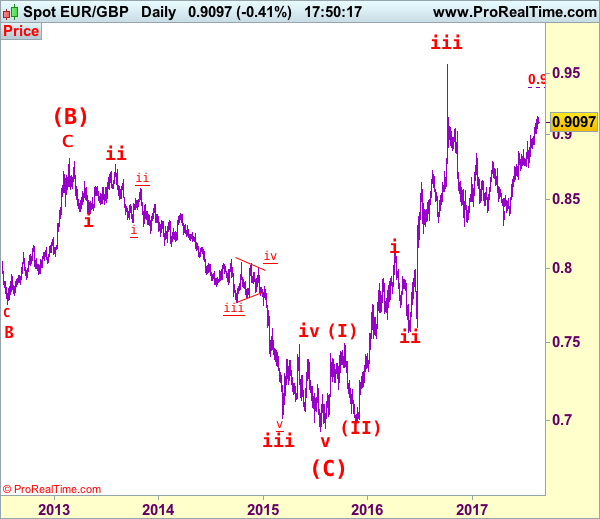

Our latest preferred count is that the wave V of a 5-wave series from 0.5682 ended at 0.9805 earlier and major from there has possibly ended at 0.8067 as A-B-C-X-A-B-C. We are keeping our view that the entire correction from 0.9805 has possibly ended at 0.7756 and as labeled as the attached daily chart and impulsive move from 0.9084 has ended at 0.7756 as a 5-waver which marked either the (C) wave or the A leg of (C), a daily close above resistance at 0.8831 would suggest (C) leg has ended and headway towards 0.9084.

On the downside, whilst initial pullback to 0.9050, then 0.9005-10 cannot be rule out, reckon downside would be limited to 0.8945-50 and bring another rise later. Below 0.8920-25 would suggest a temporary top is possibly formed, bring test of support at 0.8891 but a daily close below this level is needed to add credence to this view, bring retracement of recent upmove to 08850 and then 0.8800-10 later.

Recommendation: Buy at 0.8925 for 0.9125 with stop below 0.8825

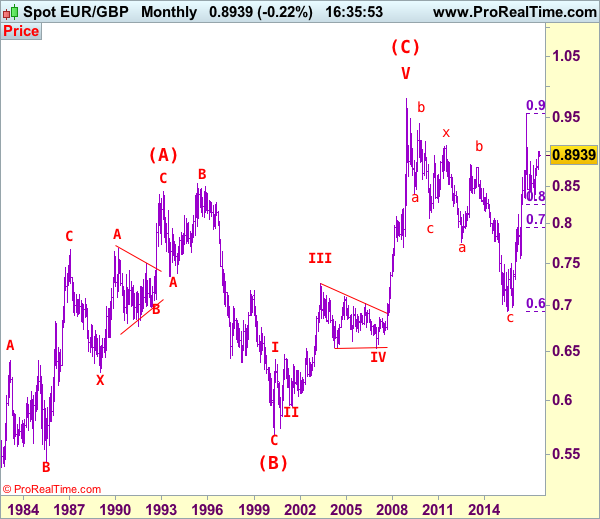

Euro’s long term uptrend started in Feb 1981 at 0.5039 and is unfolding as a (A)-(B)-(C) move with (A): 0.8433 (Feb 1993), (B): 0.5682 (May 2000) and impulsive wave (C) should have ended at 0.9805 with wave III ended at 0.7254 (May 2003), triangle wave IV at 0.6536 (23 Jan 2007) and wave V as well as wave (C) has ended at 0.9805.

We are keeping an alternate count that only wave III ended at 0.9805 and the correction from there is the wave IV and may extend weakness to 0.7700, however, it is necessary to see a daily close above resistance at 0.9143 would change this to be the preferred count.