EUR/GBP – 0.8693

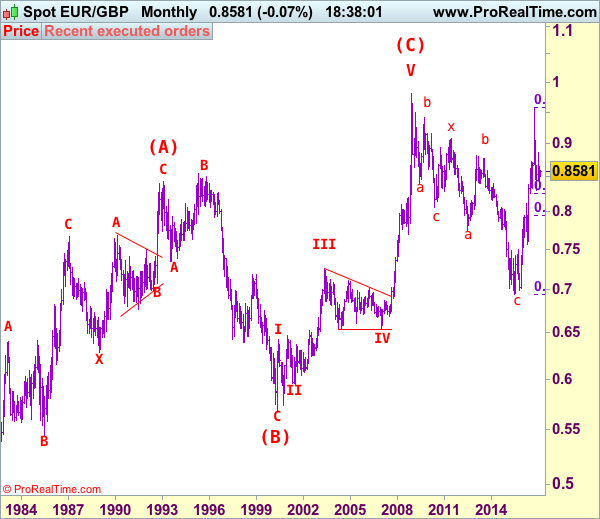

EUR/GBP – The major (A)(B)(C)-(X)-(A)(B)(C) correction from 0.9805 is unfolding and 2nd (A) has possibly ended at 0.6936.

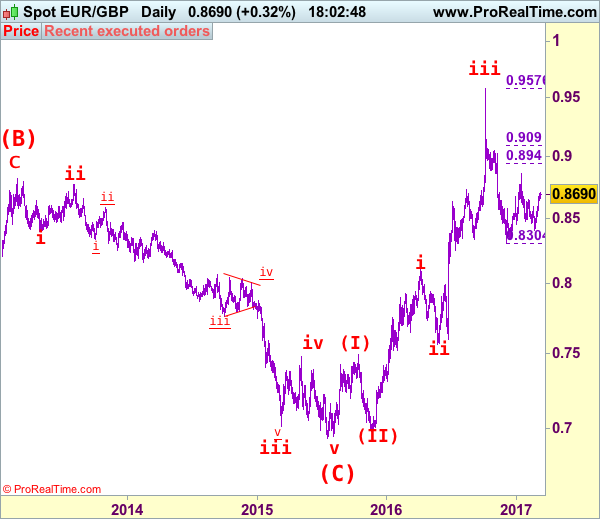

As the single currency has surged again after recent strong rebound from 0.8403 and broke above resistance at 0.8646, signaling the fell from 0.8857 has ended at 0.8403 and consolidation with mild upside bias remains for further gain to 0.8750-60, however, reckon upside would be limited to 0.8800 and price should falter well below said resistance at 0.8857.

Our latest preferred count is that the wave V of a 5-wave series from 0.5682 ended at 0.9805 earlier and major from there has possibly ended at 0.8067 as A-B-C-X-A-B-C. We are keeping our view that the entire correction from 0.9805 has possibly ended at 0.7756 and as labeled as the attached daily chart and impulsive move from 0.9084 has ended at 0.7756 as a 5-waver which marked either the (C) wave or the A leg of (C), a daily close above resistance at 0.8831 would suggest (C) leg has ended and headway towards 0.9084.

On the downside, whilst pullback to 0.8645-50 cannot be ruled out, reckon downside would be limited to 0.8600 and bring another rise later. Below 0.8545-50 would defer and suggest top is formed instead, and risk weakness to 0.8500-10 but break there is needed to provide confirmation and suggest the rebound from 0.8403 has ended.

Recommendation: Buy at 0.8600 for 0.8750 with stop below 0.8500.

Euro’s long term uptrend started in Feb 1981 at 0.5039 and is unfolding as a (A)-(B)-(C) move with (A): 0.8433 (Feb 1993), (B): 0.5682 (May 2000) and impulsive wave (C) should have ended at 0.9805 with wave III ended at 0.7254 (May 2003), triangle wave IV at 0.6536 (23 Jan 2007) and wave V as well as wave (C) has ended at 0.9805.

We are keeping an alternate count that only wave III ended at 0.9805 and the correction from there is the wave IV and may extend weakness to 0.7700, however, it is necessary to see a daily close above resistance at 0.9143 would change this to be the preferred count.