AUD/USD – 0.7823

Aussie has continued trading lower after retreating from recent high of 0.8066, suggesting a temporary top has possibly been formed there and near term downside risk remains for the retreat from there to bring retracement of early upmove, hence weakness to 0.7760 (61.8% Fibonacci retracement of 0.7571-0.8066) cannot be ruled out, however, a drop below previous resistance at 0.7712 is needed to provide confirmation, bring subsequent decline towards 0.7650.

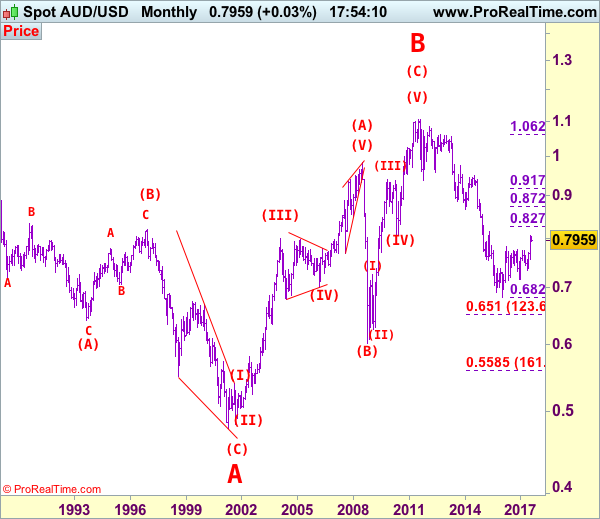

We are keeping our count that top has been formed at 1.1081 (wave 5 of V) and major correction (A-B-C-X-A-B-C) has commenced, indicated downside targets at 0.7945 (61.8% Fibonacci retracement of entire rise from 0.6007-1.1081) and 0.7750 had been met and downside bias is seen for further weakness to 0.6800, then 0.6700 but reckon 0.6500 would hold from here.

Our preferred count is that the rally from 0.6007 to 0.7270 (7 Jan 2009) is marked as wave A, the retreat to 0.6248 (2 Feb 2009) is wave B and the subsequent upmove is labeled as wave C with wave (iii) and wave (iv) ended at 0.8265 and 0.7700 respectively and wave (v) as well as 3 ended at 0.9407, then wave 4 ended at 0.8066 (instead of 0.8578). The wave 5 has met our indicated projection target of 1.1060 and could ended at 1.1081, this level is now treated as the peak of wave (C) as well as larger degree wave B, hence major fall in wave C has commenced, our initial downside target at psychological support at 0.7000 has just been met and further weakness to 0.6500 would be seen later.

On the upside, whilst recovery to 0.7875-80 cannot be ruled out, reckon resistance at 0.7919 would limit upside and bring another decline later. A daily close above this level would suggest first leg of corrective decline from 0.8066 top has ended, risk a stronger rebound to 0.7950, then 0.7980, however, upside should be limited to 0.8000 and bring another decline. A daily close above 0.8000 would bring retest of 0.8066 but break there is needed to signal medium term erratic rise from 0.6827 (2016 low) has resumed and extend gain to 0.8100, then towards previous resistance at 0.8163.

Recommendation: Stand aside for this week.

Our alternate count on the daily chart treated the top formed in 2008 at 0.9851 could be a larger degree wave I and was followed by a deep and sharp correction in wave II to 0.6007 and wave III is unfolding from there.

The long-term uptrend started from 0.4775 (2 Apr 2001) with an impulsive structure. Wave I is labeled as 0.4775 to 0.9851 (15 Jul 2008), wave II has ended at 0.6007 (Oct 2008) and wave III is still in progress which may extend further gain to 1.1265.