GBP/USD – 1.3235

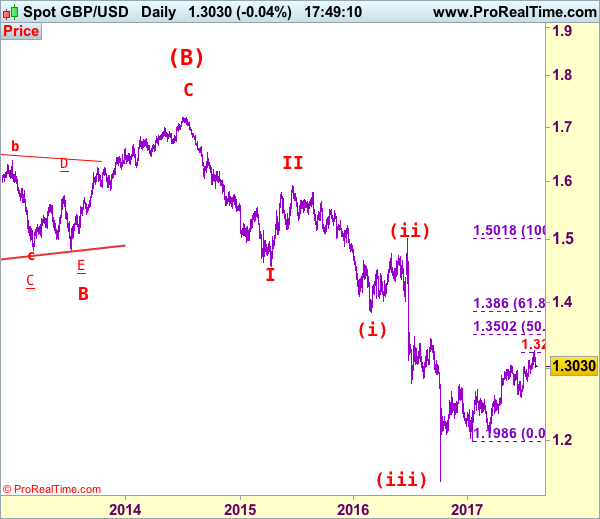

GBP/USD – Wave 4 is unfolding as an (A)-(B)-(C) and could have ended at 1.7192

Although cable extended recent upmove to 1.3269 late last week, the subsequent selloff signals top has been formed there and few weeks of consolidation below this level would be seen with downside bias for test of support at 1.2999, a daily close below this level would add credence to this view, bring further fall towards previous support at 1.2933 which is likely to hold from here. Looking ahead, a drop below 1.2933 support would signal recent upmove has indeed ended at 1.3269, bring further fall to 1.2880-85, then towards support at 1.2812.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has possibly ended at 1.7192, below support at 1.4232 would add credence to this count, then further fall to 1.4000 level would follow but reckon downside would be limited to 1.3655 support and price should stay above previous support at 1.3500.

On the upside, whilst initial recovery to 1.3080-85 cannot be ruled out, recon upside would be limited to 1.3110-20 and bring another decline later. Above resistance at 1.3165 would defer and suggest first leg of decline from 1.3269 top has ended, risk a stronger rebound to 1.3200, however, still reckon upside would be limited and price should falter below said resistance at 1.3269, bring another decline later this month.

Recommendation: Sell at 1.3120 for 1.2920 with stop above 1.3220.

Longer term – Cable’s rise from 1.0520 (Feb 1985) to 2.0100 (September 1992) is seen as [A], the decline to 1.3682 is labeled as (B) and (C) wave rally has ended at 2.1162 (9 Nov, 2007) which is also the top of larger degree wave B with circle. The selloff from there is a 5-waver with wave (A) ended at 1.3500 (23 Jan 2009), wave (B) itself is labeled as A: 1.6733, triangle wave B: 1.4813 and wave C as well as top of wave (B) ended at 1.7192 (2014), hence the selloff from there is an impulsive wave (C) with wave I : 1.4566, wave II 1.5930, an extended wave III is unfolding and already exceeded our downside target at 1.3500 and 1.3000, hence weakness to 1.2500 and possibly 1.2000 cannot be ruled out, however, price should stay well above psychological level at 1.0000.