EUR/CHF : 1.0913

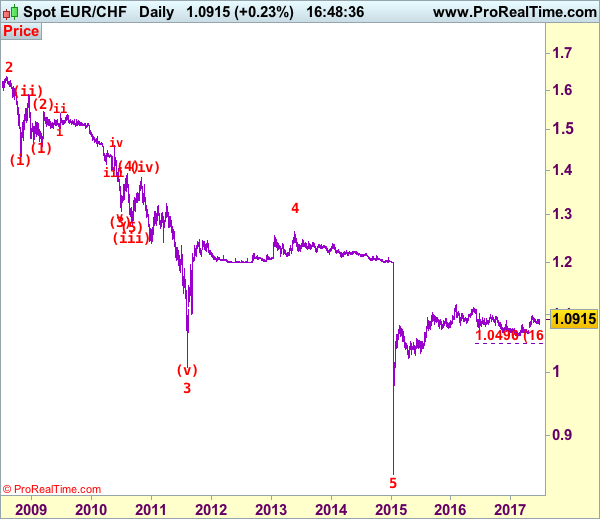

EUR/CHF: Major wave 5 trough ended at 0.8426 and correction has commenced from there for subsequent gain towards 1.1400-1.1500.

Although the single currency fell marginally to 1.0833 last week, euro found good support there and has staged another rebound, retaining our bullish view and consolidation with upside bias remains for test of resistance at 1.0910, break there would signal low is formed, bring test of 1.0949 resistance, only a daily close above there would signal the pullback from 1.0988 has ended and bring retest of this level. Looking ahead, above said resistance at 1.0988 would confirm recent rise has resumed and extend further gain to another previous resistance at 1.1001, break there would signal the upmove from 1.0622 low (2016 low) is still in progress for headway to 1.1018, then 1.1050 but reckon resistance at 1.1107 would limit upside and price should falter well below 2016 high at 1.1129.

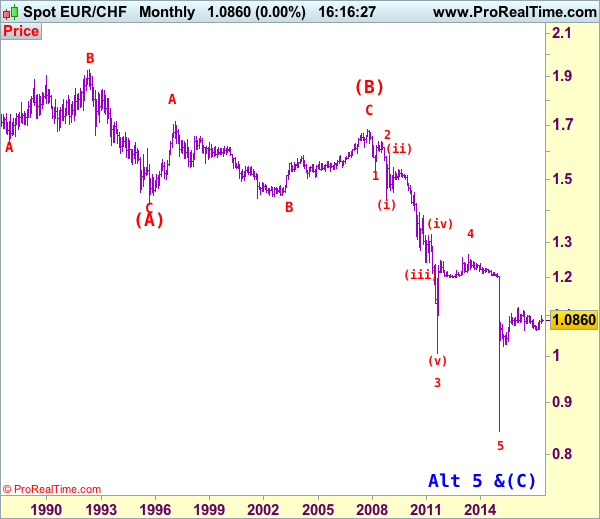

To recap our preferred count, the decline from 1.6828 (end wave (B)) is labeled as the beginning of wave (C) which should unfold as an impulsive move with 1: 1.5326, 2: 1.6377 and wave 3 is sub-divided into (i): 1.4300, (ii): 1.5880 and wave (iii) is still unfolding with (1): 1.4577, (2): 1.5448 and wave (3) is an extended 3rd with i: 1.5006, ii: 1.5383, wave iii: 1.3073, then wave iv ended at 1.3925 and wave v at 1.3073, wave (4) ended at 1.3925 and wave (5) has ended at 1.2765 which also marked the low of wave (iii) and wave (iv) has ended at 1.3835 and wave (v) as well as larger degree wave 3 has ended at 1.0075. The selloff from 1.2650 signals wave 4 has ended there and we are taking a view that the wave 5 could also have ended 0.8426, hence consolidation is seen with mild upside bias for rebound to 1.1000 first, then towards 1.1400.

On the downside, below said support at 1.0833 would risk weakness to previous support at 1.0792, however, a daily close below this level is needed to signal recent rise has ended and extend the fall from 1.0988 towards previous minor resistance at 1.0720. Looking ahead, only a drop below 1.0720 would suggest top is formed instead, risk weakness towards said support at 1.0656 first.

Recommendation: Hold long entered at 1.0905 for 1.1105 with stop below 1.0805.

The long-term downtrend started from 1.9626 (Apr 1985) to 1.4166 (Sep 1995) is treated as wave (A) with A:1.6285 (Dec 1987), B: 1.9342 (May 1992) and C: 1.4166, then wave (B) ended at 1.6828 with A: 1.7147 (Feb 1997), B: 1.4398 (Sep 2001), C: 1.6828 (Nov 2007), therefore, wave (C) is now in progress with the breakdown indicated as above. This wave (C) already met indicated downside target at 1.1455/60 and 1.1300, it could have ended at 0.8426, consolidation with mild upside bias is seen for gain to 1.1000 and later towards 1.2000.