EUR/CAD – 1.4523

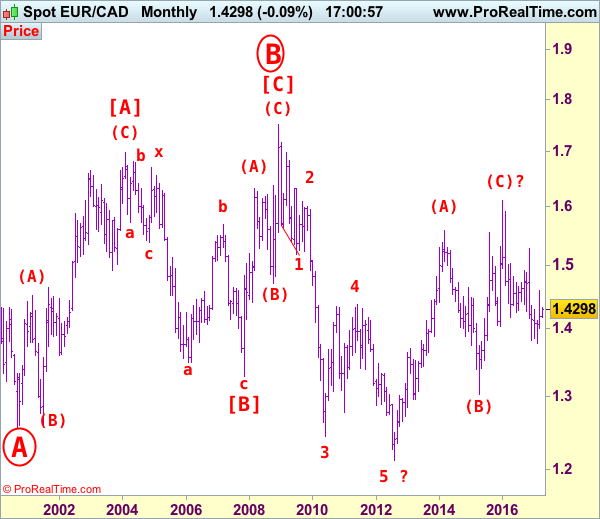

EUR/CAD: Wave 4 ended at 1.4380 and wave 5 as well as circle wave C has possibly ended at 1.2129, major (A)-(B)-(C) correction has commenced and indicated target at 1.6000 had been met.

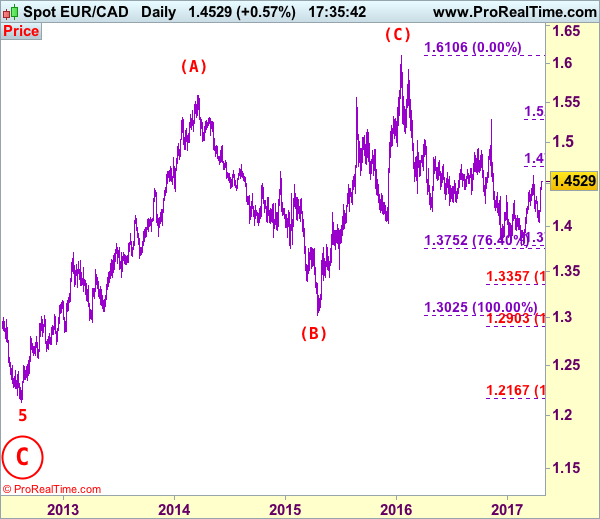

Although the single currency fell to as low as 1.4053 earlier this month, as euro found decent demand there and has staged a strong rebound, suggesting the retreat from 1.4600 has ended at 1.4053 and consolidation with upside bias is seen for test of said resistance at 1.4600, a break there would add credence to our view that low has been formed at 1.3784 back in February and bullishness remains for this erratic rise to bring a stronger retracement of recent decline to 1.4710 (61.8% Fibonacci retracement of 1.5282-1.3784) and later towards 1.4800.

Our latest preferred count is that larger degree wave [C] from 1.3289 as well as circle wave B ended at 1.7509 in Dec 2008 with (A): 1.6325, (B): 1.4719 followed by wave (C) at 1.7509, hence circle wave C is unfolding with wave 1 ended at 1.5186 (diagonal wave 1), wave 2 at 1.6096, impulsive wave 3 has ended at 1.2451, followed by wave 4 at 1.4380, in view of recent strong rebound, we are now treating the wave 5 as well as larger degree circle wave C has ended at 1.2129, hence (A)-(B)-(C) correction has commenced from there with impulsive wave (C) now unfolding and indicated initial upside target at 1.6000 had been met and reckon 1.6500 would hold.

On the downside, whilst pullback to 1.4450-60 is likely, reckon 1.4390-00 would limit downside and bring another rise to aforesaid upside targets. Below 1.4350-55 would defer and risk weakness to 1.4300 but reckon downside would be limited to 1.4250 and 1.4170-75 should remain intact, bring another rebound later.

Recommendation: Buy at 1.4400 for 1.4600 with stop below 1.4300.

On the bigger picture, our long-term count on the monthly chart is that a big sideways consolidation from 2000 low of 1.2557 has possibly ended at 1.7509 as circle wave B with [A]: 1.6976 ( (A): 1.4513, (B): 1.2612, (C): 1.6976), wave [B]: 1.3289 is a double three with 1st a-b-c: 1.5384, x: 1.6709 and 2nd a-b-c: 1.3289. As indicated above, the wave [C] has ended at 1.7509. The selloff from there is now unfolding which itself should be labeled as an impulsive wave with wave 1: 1.5186 (diagonal wave 1), followed by wave 2: 1.6096 and wave 3: 1.2451, wave 4: 1.4380, wave 5 as well as larger degree circle wave C has possibly ended at 1.2129 and major correction has possibly commenced for retracement of recent decline towards 1.4000, then 1.4180-90 (38.2% Fibonacci retracement of 1.7509-1.2129). Below said support at 1.2129 would risk weakness to psychological support at 1.2000 and then 1.1851 (50% projection of 1.7509-1.2451 measuring from 1.4380) but reckon 1.1500 would remain intact, bring reversal later.