AUD/USD – 0.7577

Recent wave: Wave 5 ended at 1.1081 and major correction has commenced for fall to 0.7000 and then towards 0.6500-10

Trend: Near term up

Original strategy :

Sell at 0.7595, Target: 0.7400, Stop: 0.7655

Position: –

Target: –

Stop: –

New strategy :

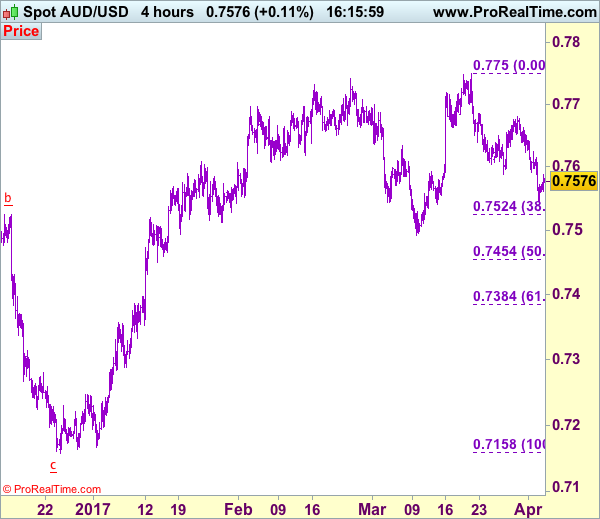

Sell at 0.7605, Target: 0.7410, Stop: 0.7665

Position: –

Target: –

Stop:-

As aussie has recovered after falling to 0.7545, suggesting consolidation above this level would be seen and corrective bounce to 0.7600-05 cannot be ruled out, however, reckon upside would be limited to resistance at 0.7625 and bring another decline later, below said support would extend the fall from 0.7750 to 0.7520-25 (38.2% Fibonacci retracement of 0.7158-0.7750) but a break below indicated support at 0.7491 is needed to retain bearishness and bring further subsequent decline to 0.7450-55 (50% Fibonacci retracement), however, near term oversold condition should limit downside to 0.7380-85 (61.8% Fibonacci retracement), risk from there is seen for a rebound later.

In view of this, would not chase this fall here and would be prudent to sell aussie on recovery as 0.7600-05 should limit upside and bring another decline later. Above 0.7625-30 would defer and risk a stronger rebound to 0.7650 but still reckon resistance at 0.7680-85 would limit upside and bring another decline later.

On the 4-hour chart, the move from 0.8066 is the wave 5 with i: 0.8860, ii: 0.8315, wave iii is an extended move ended at 1.0183, iv: 0.9706 and wave v has ended at 1.1081 (also the top of entire wave 5). The subsequent selloff is the major correction which is unfolding as ABC-X-ABC and 2nd A leg has ended at 0.8848, followed by a-b-c wave B which ended at 0.9758, hence, 2nd C wave is now in progress and indicated downside target at 0.7000 and 0.6950 had been met, so further fall to 0.6710-20 cannot be ruled out.