USD/CAD – 1.2879

Trend: Near term up

Original strategy :

Bought at 1.2765, Target: 1.2915, Stop: 1.2705

Position: – Long at 1.2765

Target: – 1.2915

Stop: – 1.2705

New strategy :

Hold long entered at 1.2765, Target: 1.2915, Stop: 1.2765

Position: – Long at 1.2765

Target: – 1.2915

Stop:- 1.2765

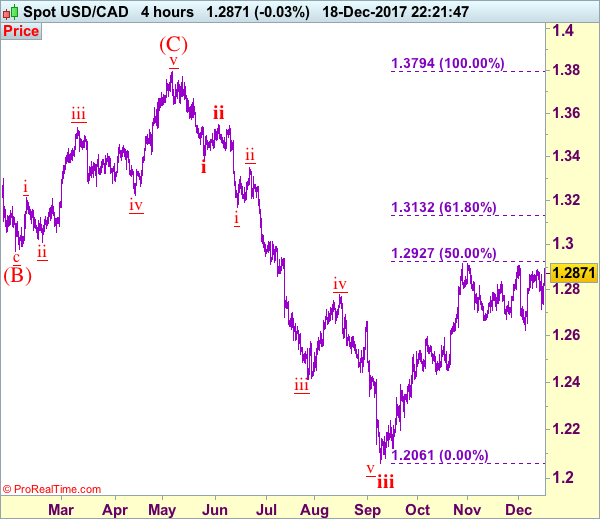

Although the greenback retreated quite sharply on Friday, as renewed buying interest emerged at 1.2713 and the pair has rallied since, retaining our bullishness and upside bias remains for another test of resistance at 1.2917 but break there is needed to confirm upmove has resumed for headway to 1.2975-80 (61.8% Fibonacci retracement of 1.3547-1.2061), then towards psychological resistance at 1.3000.

In view of this, we are holding on to our long position entered at 1.2765. Below said support at 1.2713 would abort and prolong choppy trading, bring weakness to 1.2650-55, however, downside should be limited and price should stay above said support at 1.2623, bring another rebound later.

To recap, wave B from 1.3066 is unfolding as an a-b-c and is sub-divided as a: 1.2192, b: 1.2716 and wave c is a 5-waver with i: 1.1983, ii: 1.2506, extended wave iii with minor iii at 1.0206, wave iv ended at 1.0781 and wave v as well as wave iii has ended at 0.9931, hence the subsequent choppy trading is the wave iv which is unfolding as (a)-(b)-(c) with (a) leg of iv ended at 1.0854, followed by (b) leg at 1.0108 and (c) leg as well as the wave iv ended at 1.0674. The wave v is sub-divided by minor wave (i): 0.9980, (ii): 1.0374, (iii): 0.9446, (iv): 0.9913 and (v) as well as v has possibly ended at 0.9407, therefore, consolidation with upside bias is seen for major correction, indicated target at 1.3700 and 1.4000 had been met and further gain to 1.4700 would be seen later.