GBP/USD – 1.3167

Original strategy :

Sold at 1.3315, Target:1.3115, Stop: 1.3315

Position: – Short at 1.3315

Target: – 1.3115

Stop: – 1.3315

New strategy :

Hold short entered at 1.3315, Target:1.3115, Stop: 1.3290

Position: – Short at 1.3315

Target: – 1.3115

Stop:- 1.3290

As cable met renewed selling interest at 1.3287 yesterday and has slipped again, retaining our view that top has possibly been formed at 1.3338 late last week and consolidation with downside bias remains for test of indicated support at 1.3121, however, break there is needed to signal the rebound from 1.3027 has ended, bring further fall to 1.3065-75, then retest of said support at 1.3027.

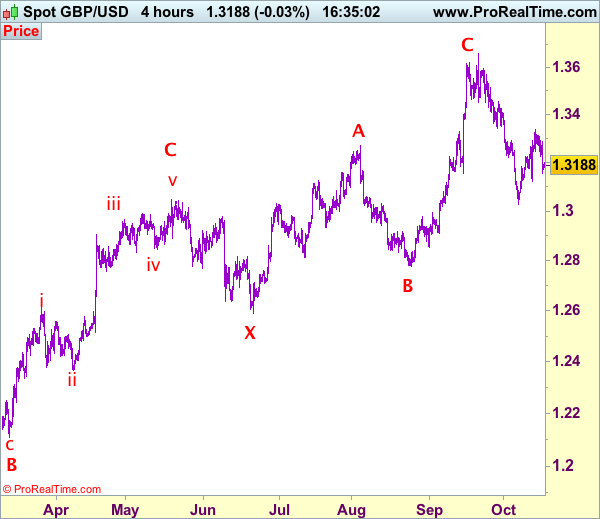

In view of this, we are holding on to our short position entered at 1.3315. Only above said resistance at 1.3312-15 would risk test of said resistance at 1.3338 (last week’s high), break there would abort and signal low has been formed at 1.3027 instead, bring at least a correction of the fall from 1.3658 top to 1.3390-00 later. Our preferred count is that (pls see the attached chart) the wave IV is unfolding as a complex double three (ABC-X-ABC) correction with 2nd wave B ended at 1.2774, hence 2nd wave C could have ended at 1.3658.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.