AUD/USD – 0.7525

Recent wave: Wave 5 ended at 1.1081 and major correction has commenced for fall to 0.7000 and then towards 0.6500-10

Trend: Near term up

Original strategy :

Sold at 0.7605, Target: 0.7450, Stop: 0.7585

Position: – Short at 0.7605

Target: – 0.7450

Stop: – 0.7585

New strategy :

Hold short entered at 0.7605, Target: 0.7450, Stop: 0.7585

Position: – Short at 0.7605

Target: – 0.7450

Stop:- 0.7585

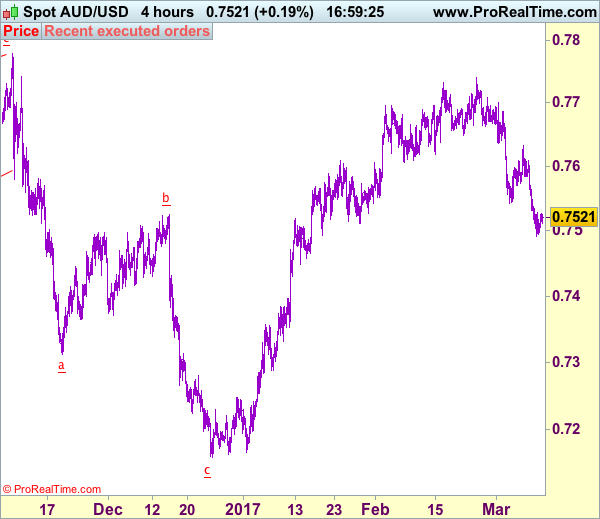

Although aussie has recovered after falling yo 0.7491 yesterday and minor consolidation above this level would be seen, reckon upside would be limited to previous support at 0.7543 and bring another decline, below said support would extend recent decline from 0.7741 top for retracement of early upmove to 0.7449 support but reckon downside would be limited and reckon 0.7400-10 would hold from here.

In view of this, we are holding on to our short position entered at 0.7605. Only above indicated resistance at 0.7633 would abort and risk a stronger rebound to 0.7665-70, above there would signal low is formed instead and suggest the retreat from 0.7741 has ended, bring a stronger rebound to 0.7700 but price should falter well below said resistance at 0.7741, bring another decline.

On the 4-hour chart, the move from 0.8066 is the wave 5 with i: 0.8860, ii: 0.8315, wave iii is an extended move ended at 1.0183, iv: 0.9706 and wave v has ended at 1.1081 (also the top of entire wave 5). The subsequent selloff is the major correction which is unfolding as ABC-X-ABC and 2nd A leg has ended at 0.8848, followed by a-b-c wave B which ended at 0.9758, hence, 2nd C wave is now in progress and indicated downside target at 0.7000 and 0.6950 had been met, so further fall to 0.6710-20 cannot be ruled out.