GBP/JPY – 140.35

Original strategy:

Sell at 141.40, Target: 139.40, Stop: 142.00

Position: –

Target: –

Stop: –

New strategy :

Sell at 141.40, Target: 139.40, Stop: 142.00

Position: –

Target: –

Stop:-

As the British pound has remained confined within recent established range, suggesting further sideways trading would take place before recent decline from 147.75 top resumes, a break below last week’s low at 139.80 would extend this decline to 139.50 but loss of downward momentum should prevent sharp fall below 139.00-10 and price should stay well above previous support at 138.70.

In view of this, we are looking to sell sterling on subsequent recovery as 141.40-50 should limit upside and bring such a decline. Only a break of resistance at 142.05 would suggest low is possibly formed instead, bring a stronger rebound to 142.50-60 but resistance at 143.20 should remain intact and bring another decline later.

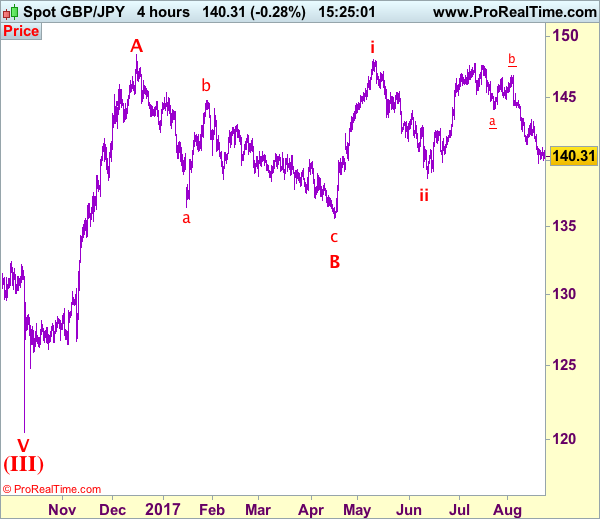

Our preferred count is that larger degree wave V with circle is unfolding from 251.12 with wave (I) 219.34, (II): 241.38 and wave (III) is subdivided into 1: 192.60, 2: 215.89 (23 Jul 2008) and wave 3 ended at 118.87 earlier in 2009. The correction from there to 162.60 is wave 4 which itself is a double three and is labeled as first a-b-c ended at 151.53, followed by wave x at 139.03, 2nd a ended at 162.60, 2nd b at 146.75 and 2nd c leg of wave 4 ended at 163.00. Therefore, the decline from 163.00 to 116.85 is now treated as wave 5 which also marked the end of larger degree wave (III), hence wave (IV) major correction has commenced for retracement of the wave (III) from 241.38 and upside target at 183.95-00 (50% Fibonacci retracement of the wave (II) from 241.38) had been met, a drop below 160.00 would suggest wave (IV) has ended at 195.85, bring decline in wave (V) for initial weakness to 130 (already met) and 120.