GBP/USD – 1.2591

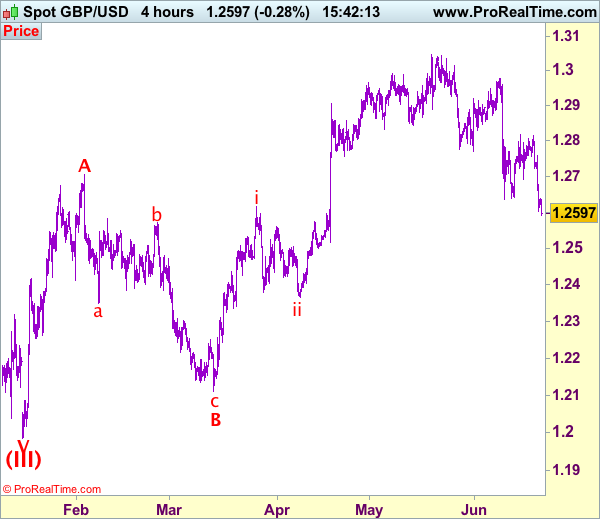

Recent wave: Wave V of larger degree wave (III) has ended at 1.1986 and major correction has commenced from there for gain to 1.3000 and 1.3140-50

Trend: Near term down

Original strategy :

Sell at 1.2750, Target: 1.2600, Stop: 1.2810

Position: –

Target: –

Stop: –

New strategy :

Sell at 1.2675, Target: 1.2525, Stop: 1.2735

Position: –

Target: –

Stop:-

Yesterday’s selloff together with the breach of previous support at 1.2635 add credence to our view that recent decline from 1.3048 top has resumed and bearishness remains for this move to bring retracement of early upmove to 1.2550, then towards previous support at 1.2515, however, loss of near term downward momentum should prevent sharp fall below 1.2490-00 and reckon 1.2450-60 would hold.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.

On the upside, whilst recovery to 1.2640-50 cannot be ruled out, reckon 1.2675-80 would limit upside an bring another decline. Above previous support at 1.2723 would defer and risk a stronger rebound to 1.2758 but break of this resistance is needed to signal a temporary low is formed instead, risk test of 1.2818 resistance later.