GBP/USD – 1.2896

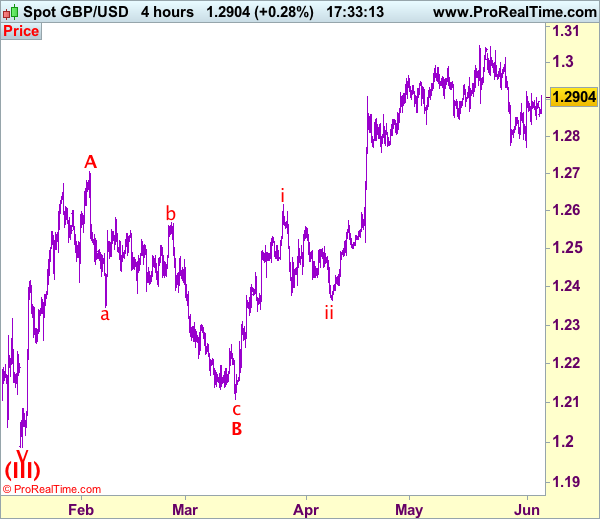

Recent wave: Wave V of larger degree wave (III) has ended at 1.1986 and major correction has commenced from there for gain to 1.3000 and 1.3140-50

Trend: Near term up

Original strategy :

Sold at 1.2920, Target: 1.2770, Stop: 1.2920

Position: – Short at 1.2920

Target: – 1.2770

Stop: – 1.2920

New strategy :

Hold short entered at 1.2920, Target: 1.2770, Stop: 1.2920

Position: – Short at 1.2920

Target: – 1.2770

Stop:- 1.2920

The British pound has remained confined within recent established range and further consolidation is in store, however, as long as indicated resistance at 1.2921 holds, mild downside bias remains for another retreat, below 1.2830-40 would signal the rebound from 1.2769 has ended, bring weakness to 1.2800, then retest of said support, break there would extend recent decline from 1.3048 to support at 1.2757 which is likely to hold on first testing.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.

On the upside, above 1.2921-26 (said resistance and previous support) would defer and suggest low has been formed instead, risk a stronger rebound to 1.2965-70 and possibly towards 1.3000 but only break of resistance at 1.3015 would signal the retreat from 1.3048 has ended.