AUD/USD – 1.2554

Recent wave: Wave 5 ended at 1.1081 and major correction has commenced for fall to 0.7000 and then towards 0.6500-10

Trend: Near term up

New strategy :

Buy at 1.2400, Target: 1.2600, Stop: 1.2340

Position: –

Target: –

Stop:-

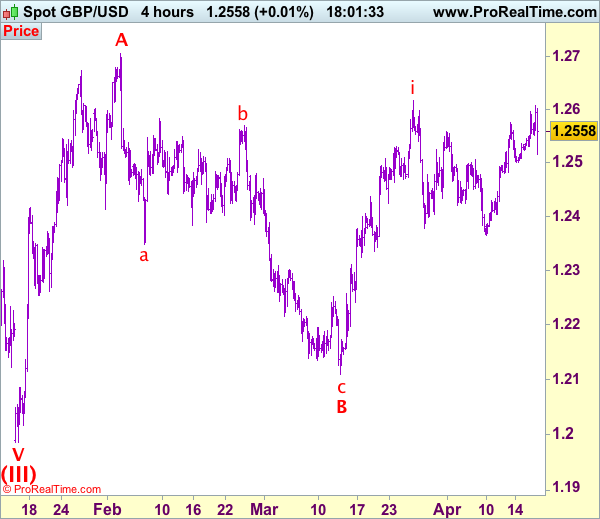

Cable found decent demand at 1.2109 earlier last month and staged a strong rebound from there since, suggesting the wave c as well as larger degree wave B has ended there, hence impulsive wave C has commenced from there with wave i of C ended at 1.2616, follow by a corruption back to 1.2365 (either end of wave ii or first a-b-c of ii). Although sterling staged a strong rebound from there, break of 1.2616 is needed to confirm upmove has resumed and extend gain to 1.2660-70, then 1.2706 (wave A top) but reckon upside would be limited to 1.2770-80.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.

On the downside, whilst initial pullback to 1.2495-00 is likely, reckon downside would be limited to 1.2440-50 and 1.2395-00 should attract renewed buying interest and bring another rally later. Only a break of said support at 1.2365 would abort and shift risk to downside for a deeper wave ii correction later.