Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 03 May 2016

• Trend bias: Down

Daily

• Last Candlesticks pattern: Shooting star

• Time of formation: 3 May 2016

• Trend bias: Sideways

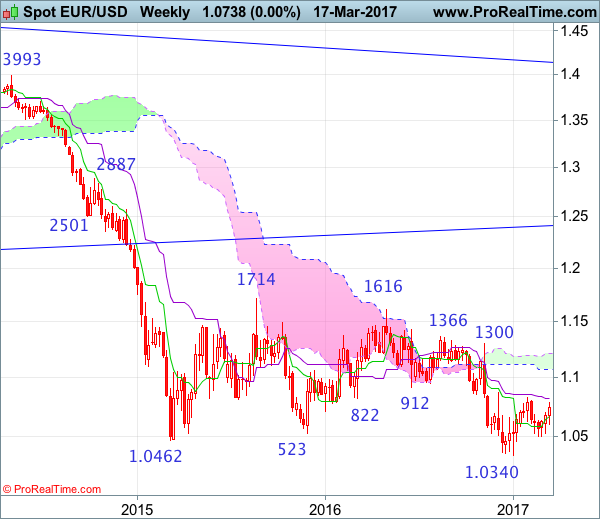

EUR/USD – 1.0765

The single currency found renewed buying interest at 1.0600 last week and has rallied again in line with our bullish expectation, our long position entered at 1.0580 met our upside target at 1.0780 with 200 points profit as price rose to as high as 1.0782, this anticipated rise adds credence to our bullish view that the fall from 1.0829 has ended at 1.0493 earlier and upside bias remains for further gain to 1.0790-00 but break of said resistance at 1.0829 is needed to confirm early erratic rise from 1.0340 low for further subsequent gain to 1.0890-00 and possibly 1.0930-35 (61.8% Fibonacci retracement of 1.1300-1.0340) which is likely to hold on first testing.

On the downside, whilst initial pullback to 1.0680-90 cannot be ruled out, as long as support at 1.0600 holds, mild upside bias remains for further gain to indicated upside targets. A drop below said support at 1.0600 would abort and signal the rebound from 1.0493 has ended instead, bring further fall to 1.0550 and possibly 1.0525 but said support at 1.0493 should remain intact. Only a drop below support at 1.0493 would signal shift risk back to downside and extend far to 1.0454 support, a sustained breach below there is needed to confirm the rebound from 1.0340 (Jan low) has ended, bring further fall to 1.0400 and later retest of said support which is likely to hold from here.

Recommendation: Long entered at 1.0580 met target at 1.0780 with 200 points profit and would buy again at 1.0690 for 1.0890 with stop below 1.0590.

On the weekly chart, euro found good support at 1.0525 last week and has rebounded again, a white candlestick with a relatively long lower shadow was formed, retaining our bullish view that further consolidation above 1.0493 would be seen and mild upside bias remains for another bounce to 1.0770-80, however, only a break of resistance at 1.0829 would suggest another leg of rise from 1.0340 low is underway, bring retracement of early decline to previous resistance at 1.0873 and later 1.0930-35 (61.8% Fibonacci retracement of 1.1300-1.0340) but reckon 1.1000 would limit upside and price should falter below 1.1050-60.

On the downside, although pullback to 1.0690-00 is likely, reckon 1.0600 would hold and bring another rebound. Below said support at 1.0600 would suggest the rebound from 1.0493 has ended, risk weakness to 1.0525 support but break there is needed to risk retest of said support at 1.0493-96, a drop below 1.0493-96 would extend the retreat from 1.0829 towards key support at 1.0454, however, only a sustained breach below this level would signal the rebound from 1.0340 has ended, then further fall to 1.0390-00 and later retest of this January low would follow.