Weekly

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 10 Jul 2017

• Trend bias: Up

Daily

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 18 Jul 2017

• Trend bias: Up

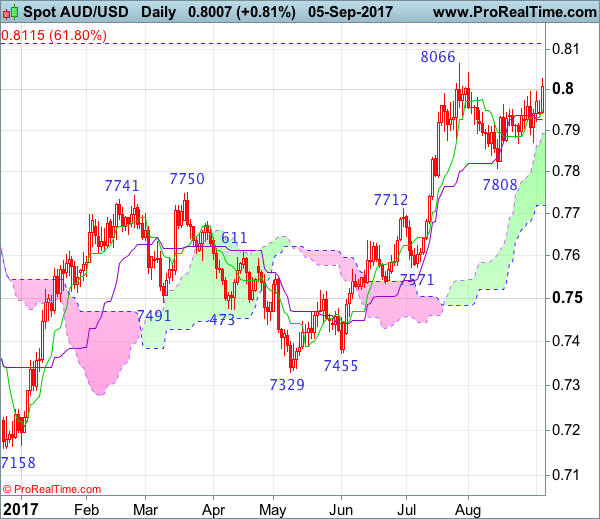

Although aussie retreated last week to as low as 0.7871, as renewed buying interest emerged there and the pair has risen again, retaining our bullishness (we recommended to buy at 0.7920 and a long position was entered) for gain towards recent high at 0.8066, however, break there is needed to confirm recent upmove has resumed and extend the medium term erratic rise from 0.6827 to 0.8163 resistance, then 0.8200 but loss of near term upward momentum should limit upside and reckon another previous resistance at 0.8295 would hold.

On the downside, whilst pullback to the Tenkan-Sen (now at 0.7950) cannot be ruled out, reckon 0.7921 support would hold and bring another rise to aforesaid upside targets later. Below support at 0.7867-71 would abort and prolong consolidation, risk weakness to 0.7830 but indicated support at 0.7808 should hold from here. Only below said support at 0.7808 would signal the corrective fall from 0.8066 temporary top is still in progress for retracement of recent upmove to 0.7760 (61.8% Fibonacci retracement of 0.7571-0.8066) but reckon downside would be limited to previous resistance at 0.7712 and 0.7670-75 would hold from here, bring another rebound later.

Recommendation: Hold long entered at 0.7920 for 0.8120 with stop now at break-even.

On the weekly chart, as aussie has surged again after finding renewed buying interest at 0.7871, retaining our view that the pullback from 0.8066 has ended at 0.7808 earlier and consolidation with upside bias remains for gain towards said resistance at 0.8066, however, break there is needed to confirm recent erratic rise from 0.6827 low has resumed and extend upmove to previous resistance at 0.8163, then 0.8250 but near term overbought condition should limit upside to another previous resistance at 0.8295 and price should falter below 0.8390-00, bring retreat later.

On the downside, expect pullback to be limited to this week’s low at 0.7938 and bring another rise later. Only below support at 0.7867-71 would defer and risk another test of said support at 0.7808, a weekly close below there would revive near term bearishness for retracement of recent rise to 0.7750, however, a sustained breach below previous resistance at 0.7712 is needed to signal a temporary top has been formed at 0.8066, bring test of the Kijun-Sen (now at 0.7698), then towards 0.7600-10 but support at 0.7571 should contain weakness.