Weekly

• Last Candlesticks pattern: N/A

• Time of formation: N/A

• Trend bias: Up

Daily

• Last Candlesticks pattern: Long black candlestick

• Time of formation: 1 Aug 2017

• Trend bias: Up

NZD/USD – 0.7237

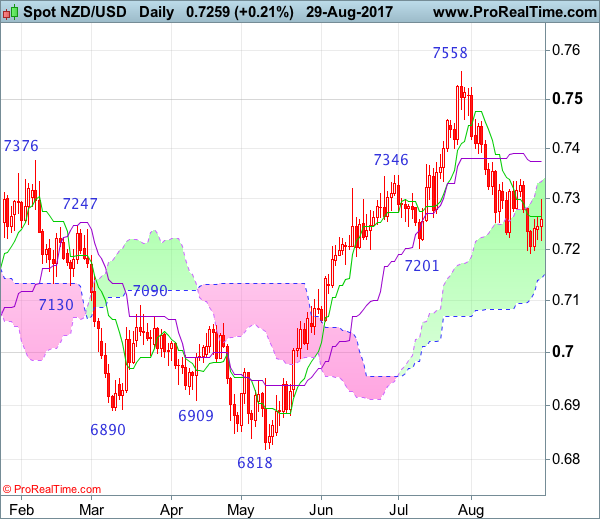

As kiwi found good support at 0.7192 last week and has recovered since, suggesting consolidation above this level would be seen and recovery to 0.7299, then 0.7335-40 cannot be ruled out, however, reckon the Kijun-Sen (now at 0.7375) should limit upside and bring another decline later. Below 0.7215-20 would bring retest of said support at 0.7192 but break there is needed to confirm the fall from 0.7558 top has resumed and extend weakness to 0.7145-50, then towards 0.7095-00 which is likely to hold from here due to near term oversold condition and bring rebound later.

On the upside, whilst initial recovery to 0.7300 cannot be ruled out, reckon upside would be limited to the Kijun-Sen (now at 0.7375) and bring another decline later. Above 0.7390-00 would suggest first leg of decline form 0.7558 has ended instead, risk a stronger rebound to 0.7440-50 but upside would still be limited and price should falter well below said resistance at 0.7558, bring another retreat later.

Recommendation: Sell at 0.7370 for 0.7170 with stop below 0.7470.

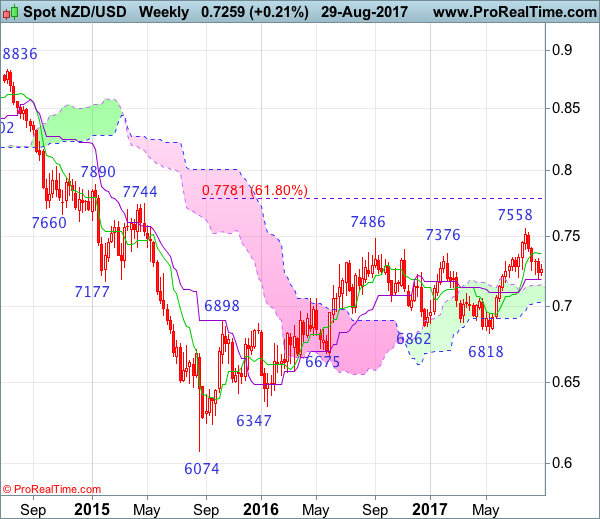

On the weekly chart, although kiwi has recovered after finding support at 0.7192, as the sharp retreat from 0.7558 suggests top has possibly been formed there, reckon upside would be limited to the Tenkan-Sen (now at 0.7375) and bring another decline, below said support at 0.7192 would extend the retreat from 0.7558 for retracement of recent rise to the upper Kumo (now at 0.7147) and then 0.7090-00 but reckon downside would be limited to the lower Kumo (now at 0.7026) and psychological support at 0.7000 would hold from here.

On the upside, expect recovery to be limited to 0.7300-10 and the Tenkan-Sen (now at 0.7375) should hold, bring another decline later. Above 0.7417 resistance would risk a stronger rebound to 0.7490-00 but still reckon said resistance at 0.7558 would limit upside and bring another retreat later. Only a break of 0.7559 would extend medium term erratic upmove from 0.6074 (2015 low) has resumed and may extend gain to 0.7690-00 (61.8% projection of 0.6074-0.7485 measuring from 0.6818) and later towards 0.7780-85 (61.8% Fibonacci retracement of 0.8836-0.6074), however, reckon upside would be limited to 0.7890 and price should falter well below resistance at 0.8035.