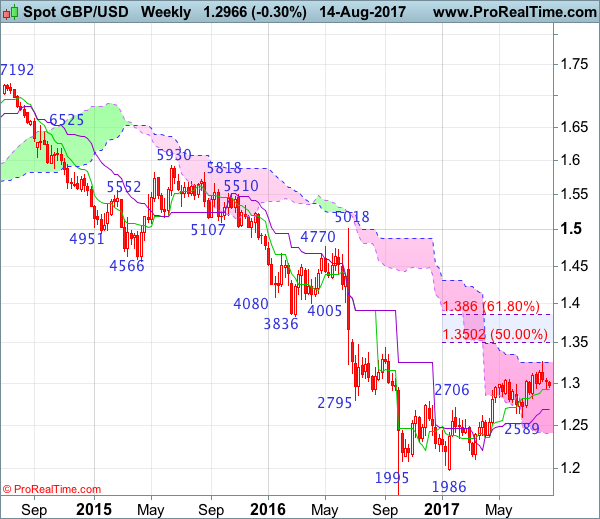

Weekly

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 16 Jan 2017

• Trend bias: Down

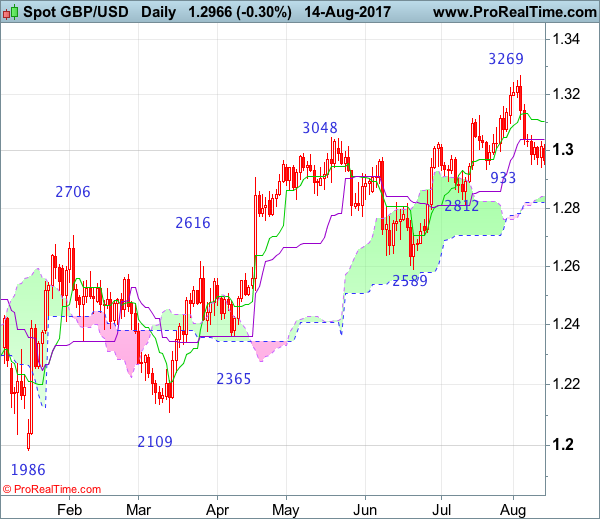

Daily

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 18 Apr 2017

• Trend bias: Near term up

GBP/USD – 1.2961

Cable continued meeting renewed selling interest just above 1.3000 level and has remained under pressure, adding credence to our view that a temporary top has been formed earlier at 1.3269 and further consolidation below this level would take place with mild downside bias for a test of indicated previous support at 1.2933, once this level is penetrated, this would signal recent upmove is over, bring further fall to 1.2890, then towards previous support at 1.2812 which is expected to contain downside.

On the upside, whilst recovery to 1.3020-30 cannot be ruled out, reckon upside would be limited to 1.3055-60 and bring another decline later. A daily close above the Tenkan-Sen (now at 1.3105) would defer and risk a stronger rebound to 1.3150 and possibly towards 1.3200 but price should falter well below said resistance at 1.3269, bring another leg of corrective decline later. A daily close above 1.3200 would risk another test of said resistance at 1.3269 but break there is needed to confirm recent upmove has resumed and extend gain to 1.3300-10, having said that, loss of upward momentum should prevent sharp move beyond resistance at 1.3425 and price should falter well below 1.3500-05 (50% Fibonacci retracement of 1.5018-1.1986).

Recommendation: Sell at 1.3050 for 1.2850 with stop above 1.3150.

On the weekly chart, the British pound ran into resistance at 1.3269 earlier this month and has retreated since, the black candlestick with a long upper shadow (shooting star alike) suggests a temporary top is possibly formed there and consolidation with mild downside bias is seen for test of the Tenkan-Sen (now at 1.2929), a weekly close below this level would bring correction of recent rise to 1.2880-85, however, reckon downside would be limited to support at 1.2812 and downside would be limited to 1.2700-10, price should stay well above support at 1.2589, bring a rebound later.

On the upside, expect recovery to be limited to 1.3055-60 and bring such a retreat later to aforesaid downside targets. Above 1.3165 resistance would defer and suggest the retreat from 1.3269 has possibly ended, bring retest of this level, break there would extend the erratic rise from 1.1986 low for retracement of early downtrend to 1.3300-10 and 1.3350-60, however, near term overbought condition should limit upside to previous resistance at 1.3425 and reckon 1.3500-05 (50% Fibonacci retracement of 1.5018-1.1986) would hold, price should falter below 1.3670-75, bring another decline in Q4.