Weekly

• Last Candlesticks pattern: Long white candlestick

• Time of formation: 22 May 2017

• Trend bias: Up

Daily

• Last Candlesticks pattern: Hammer

• Time of formation: 14 Mar 2017

• Trend bias: Up

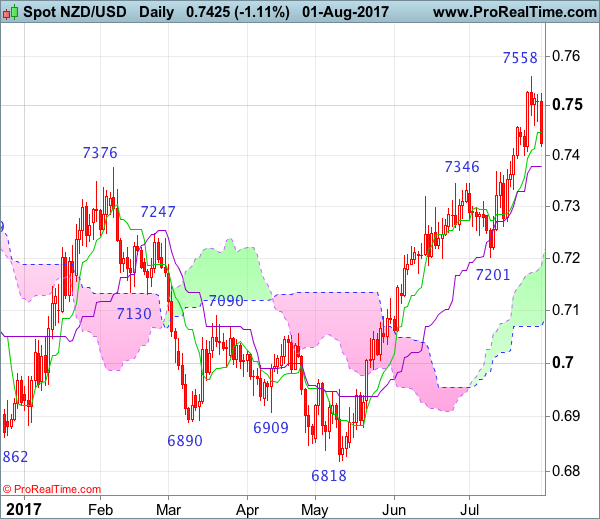

NZD/USD – 0.74

25

Kiwi has continued heading north in part due to broad-based weakness in the greenback and price just broke above previous resistance at 0.7486 , adding credence to our bullish view medium term erratic upmove from 0.6074 (2015 low) has resumed and upside bias remains for this move to extend gain to 0.7610-20, then towards 0.7690-00 (61.8% projection of 0.6074-0.7486 measuring from 0.6818), however, near term overbought condition should prevent sharp move beyond 0.7750 and reckon 0.7800-10 would hold from here, bring retreat later.

On the downside, whilst initial pullback to the Tenkan-Sen (now at 0.7440) is likely, reckon downside would be limited to 0.7401 support) and the Kijun-Sen (now at 0.7380) would hold, bring another upmove later. A daily close below the Kijun-Sen would defer and suggest a temporary top is possibly formed, bring retracement of recent rise to 0.7330-35, however, still reckon downside would be limited to support at 0.7262 and price should stay well above support at 0.7201, bring another rally.

Recommendation: Buy at 0.7400 for 0.7600 with stop below 0.7300.

On the weekly chart, kiwi extended recent upmove and has finally penetrated indicated previous resistance at 0.7486, adding credence to our bullish view that medium term erratic upmove from 0.6074 (2015 low) has resumed and may extend gain to 0.7690-00 (61.8% projection of 0.6074-0.7485 measuring from 0.6818) and later towards 0.7780-85 (61.8% Fibonacci retracement of 0.8836-0.6074), however, reckon upside would be limited to 0.7890 and price should falter well below resistance at 0.8035.

On the downside, although initial pullback to 0.7400-10 is likely, reckon the Tenkan-Sen (now at 0.7336) would limit downside and bring another rise later. Below support at 0.7201 would defer and suggest top is possibly formed, risk test of the Kijun-Sen (now at 0.7188) first, however, a weekly close below there is needed to add credence to this view, bring correction of recent rise to the upper Kumo (now at 0.7140), then 0.7090-00 but reckon support at 0.7035 would hold from here.