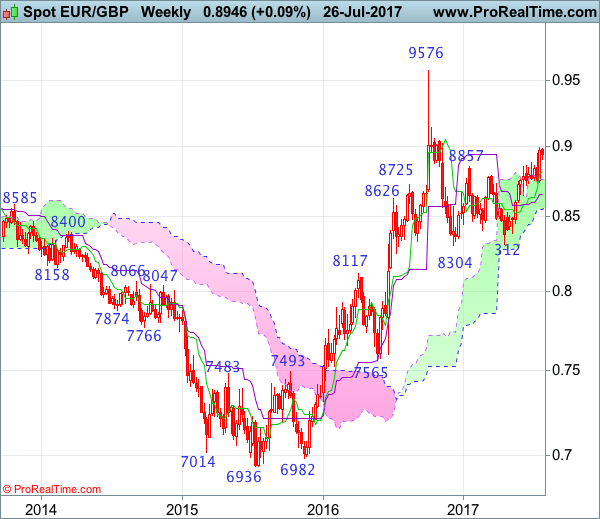

Weekly

• Last Candlesticks pattern: N/A

• ime of formation: N/A

• Trend bias: Near term up

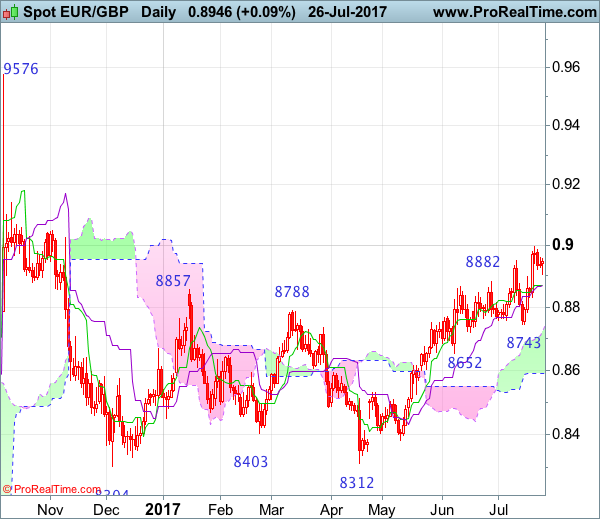

Daily

• Last Candlesticks pattern: Hammer

• Time of formation: 3 Feb 2016

• Trend bias: Up

EURGBP – 0.8776

The single currency only retreated to 0.8743 earlier this month before finding renewed buying interest and euro has surged again from there, adding credence to our bullish view for recent upmove to extend further gain (indicated upside targets at 0.8900 and 0.8940-50 – 50% Fibonacci retracement of 0.9576-0.8304 had been met), upside bias remains for further gain to psychological resistance at 0.9000, break there would extend headway to 0.9090 (61.8% Fibonacci retracement), however, loss of momentum should prevent sharp move beyond 0.9150-60, bring retreat later.

On the downside, whilst initial pullback to the Tenkan-Sen (now at 0.8869), then 0.8800 is likely, reckon support at 0.8743 would remain intact, bring another upmove later. A drop below this support would abort and suggest a temporary top is possibly formed instead, bring retracement of recent upmove to 0.8695-00, however, still reckon downside would be limited to previous support at 0.8652 and price should stay above the lower Kumo (now at 0.8589) and bring rebound later.

Recommendation: Buy again at 0.8795 for 0.8995 with stop below 0.8695.

On the weekly chart, last week’s rally together with the breach of previous resistance at 0.8950 adds credence to our bullish view that the rise from 0.8304 is still in progress and upside bias remains for this move to extend gain to 0.9000, then towards 0.9090 (61.8% Fibonacci retracement of 0.9576-0.8304) would be seen, however, a weekly close above resistance at 0.9142 is needed to retain bullishness and signal the entire correction from 0.9576 top has ended at 0.8304 and encourage for further subsequent gain to 0.9200-10.

On the downside, although pullback to the Tenkan-Sen (now at 0.8824) cannot be ruled out, reckon downside would be limited to 0.8795-00 and bring another rise later. Below support at 0.8743 support would defer and risk correction to 0.8700 but reckon downside would be limited to the Kijun-Sen (now at 0.8654) and the lower Kumo (now at 0.8551) should remain intact, bring another rally later.