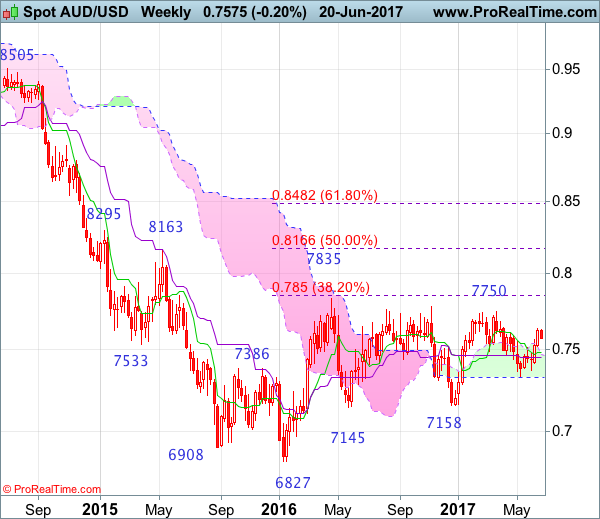

Weekly

• Last Candlesticks pattern: Shooting doji

• Time of formation: 20 Feb 2017

• Trend bias: Sideways

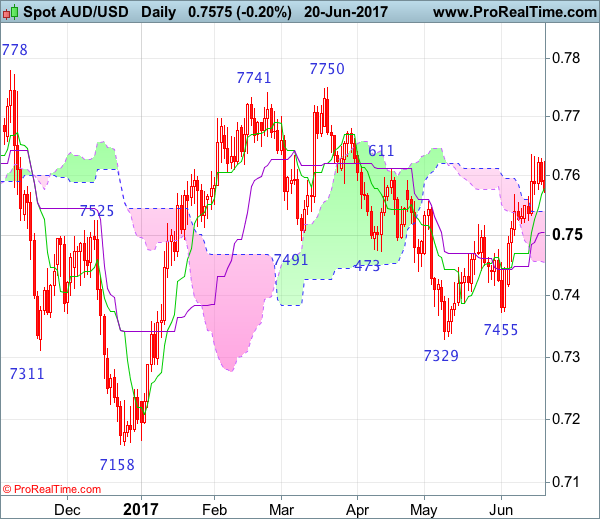

Daily

• Last Candlesticks pattern: Bearish engulfing pattern

• Time of formation: 21 Mar 2017

• Trend bias: Near term down

As aussie met resistance at 0.7636 last week and has eased, suggesting minor consolidation below this level would be seen and pullback to 0.7540-50, then 0.7515-20 cannot be ruled out, however, reckon the Kijun-Sen (now at 0.7510) would remain intact and bring another rise later, above said resistance at 0.7636 would extend recent upmove from 0.7329 low to previous resistance at 0.7680, having said that, aussie needs to break this level to signal the fall from 0.7750 top has ended and bring subsequent retest of said chart resistance at 0.7750.

On the downside, whilst initial pullback to 0.7550 cannot be ruled out, reckon the Kijun-Sen (now at 0.7510) would limit downside and bring another rise later. Below 0.7455-60 would defer and risk weakness towards 0.7400-10 but support at 0.7372 should remain intact. Looking ahead, only below 0.7372 would revive bearishness and suggest the rebound from 0.7329 has ended, bring retest of this level, break there would extend recent fall from 0.7750 top to 0.7300 and possibly 0.7250-60 but reckon downside would be limited to 0.7200-10 and price should stay well above indicated previous chart support at 0.7158.

Recommendation: Buy at 0.7510 for 0.7710 with stop below 0.7410.

On the weekly chart, aussie has surged again last week and another white candlestick was formed, adding credence to our view that the retreat from 0.7750 has ended at 0.7329 and consolidation with upside bias remains for further gain to 0.7680, however, break there is needed to add credence to this view and bring retest of this level later. Looking ahead, only a break above 0.7750 would another leg of the major rise from 0.6827 low is underway for retest of 0.7778, then towards last year’s high at 0.7835.

On the downside, expect pullback to be limited to 0.7500-10 and bring another rise. Below the Kijun-Sen (now at 0.7454) would prolong consolidation and risk weakness to 0.7410-15 but break of support at 0.7372 is needed to signal the rebound from 0.7329 has ended, bring retest of this level first. A break below there would extend recent decline from 0.7750 to 0.7290-00 and possibly towards 0.7230, however, downside should be limited to 0.7200 and price should stay well above previous support at 0.7158, risk from there is seen for a rebound to take place later.