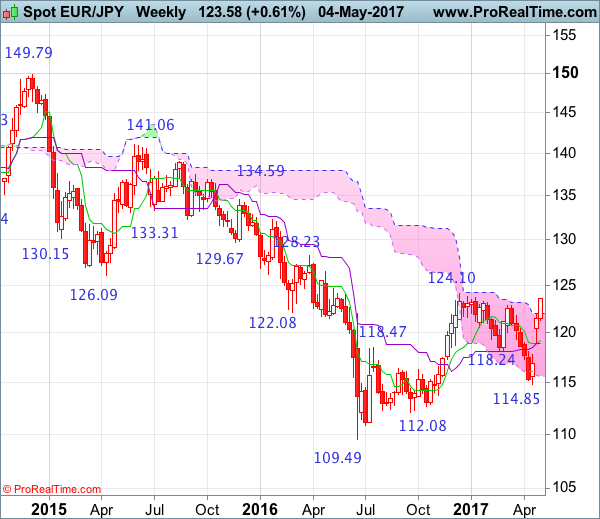

Weekly

• Last Candlesticks pattern: Hammer

• Time of formation: 19 Sep 2016

• Trend bias: Down

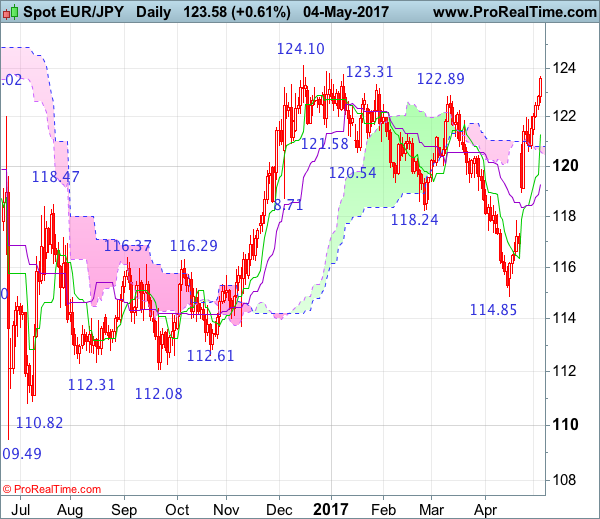

Daily

• Last Candlesticks pattern: Doji

• Time of formation: 28 Mar 2017

• Trend bias: Near term up

EUR/JPY – 123.12

As the single currency has surged again after last week’s gap-up opening and broke above indicated previous resistance at 123.31, adding credence to our view that correction from 124.10 has ended and retest of this level is likely, however, break there is needed to provide confirmation that early upmove from 109.49 low has resumed, then headway to 124.50-60 and later 125.00 would be seen but near term overbought condition should limit upside to 125.25-30 (50% Fibonacci retracement of 141.06-109.49) and reckon 125.90-00 would hold from here.

On the downside, whilst initial pullback to 122.00-10 cannot be ruled out, reckon downside would be limited to the Tenkan-Sen (now at 121.40) and 121.00 should hold, bring another upmove later to aforesaid upside targets. Only a drop below support at 120.60 would suggest a temporary top is formed instead, bring correction of recent upmove to 120.00 but downside should be limited to 119.40-50 and price should stay well above indicated support at 118.92 (last week’s low) and bring rebound later.

Recommendation: Buy at 121.00 for 124.00 with stop below 120.00.

On the weekly chart, the single currency has risen again after opening higher last week and the breach of indicated resistance at 123.31 adds credence to our view that correction from 124.10 has ended, suggesting the erratic rise from 109.49 has resumed, above 124.10 resistance would provide confirmation, bring retracement of medium term downtrend to 124.85-90 (38.2% Fibonacci retracement of 149.79-109.49), then 125.25-30 (50% Fibonacci retracement of 141.06-109.49) but reckon upside would be limited to 126.00 and 126.45-50 would hold, bring retreat later.

On the downside, although initial pullback to the upper Kumo (now at 122.04) cannot be ruled out, reckon downside would be limited to 121.00-10 and bring another rise. Below support at 120.60 would defer and risk weakness to 120.00 but reckon the Tenkan-Sen (now at 119.27) would limit downside and support at 118.92 should hold, bring another rebound later. A drop below 118.92 would shift risk to downside for further fall to 118.00, however, downside should be limited to previous resistance at 117.82 and bring rebound later. A weekly close below 117.82 would suggest first leg of rebound from 114.85 has ended, bring weakness to 117.00 but price should stay above 116.20-25, bring another rebound later.