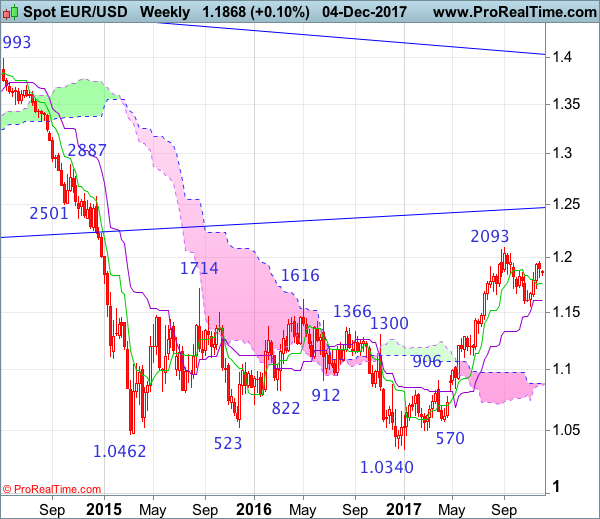

Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 7 Mar 2017

• Trend bias: Sideways

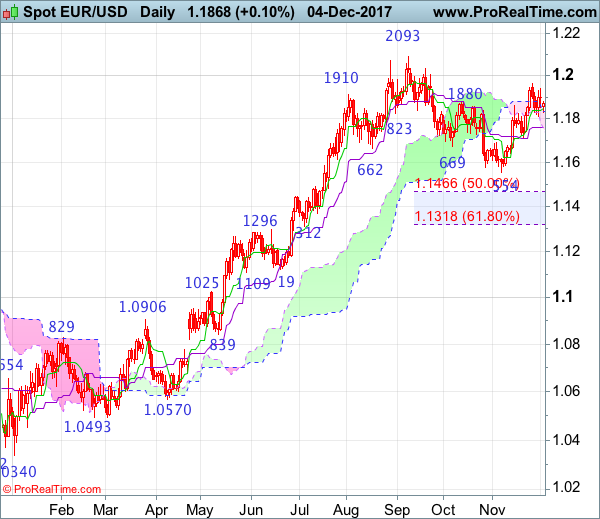

Daily

• Last Candlesticks pattern: Morning star

• Time of formation: 9 May 2017

• Trend bias: Near term up

USD/CHF – 0.9859

The greenback only slipped to as low as 0.9735 last week before staging the anticipated rebound (we recommended in our previous update to buy at 0.9730 and just missed our long entry), suggesting consolidation above this level would be seen and test of the Kijun-Sen (now at 0.9887) is likely, however, a sustained breach above this level is needed to signal low has been formed there, bring a stronger rebound to 0.9950-55, once this level is penetrated, this would signal the fall from 1.0039 has ended at 0.9735, bring test of indicated resistance at 1.0018, above there would provide confirmation and bring retest of this level first.

On the downside, expect pullback to be limited to 0.9800-10 and bring another rebound to aforesaid upside targets. Only a drop below said support at 0.9735 would abort and signal top has been formed at 1.0039 earlier, bring retracement of recent upmove from 0.9421 to minor support at 0.9670, then 0.9642 (another support) but reckon downside would be limited to 0.9590-00 and support at 0.9565 should remain intact.

Recommendation: Buy at 0.9810 for 1.0000 with stop below 0.9730.

On the weekly chart, although dollar fell to as low as 0.9735 late last week, the greenback found decent demand there and has staged a strong rebound, the pair opened higher this week and test of resistance at 0.9882 is likely break there would extend gain to 0.9947-50 but a weekly close above there is needed to signal the pullback from 1.0039 has ended, bring a test of 0.9987, break there would signal upmove has resumed for retest of 1.0039, above there would extend the rise from 0.9421 low to previous resistance at 1.0100-08, having said that, overbought condition should prevent sharp move beyond previous resistance at 1.0171 and 1.0200-10 should hold from here.

On the downside, although initial pullback to 0.9800-10 cannot be ruled out, price should stay well above support at 0.9730-35 and bring another rise later. A weekly close below there would defer and signal top is formed instead, this also suggest first leg of rebound from 0.9737 has ended and bring weakness to 0.9690-00, however, reckon support at 0.9642 would limit downside and price should stay above support at 0.9565 and the greenback shall stage another strong rebound next month.