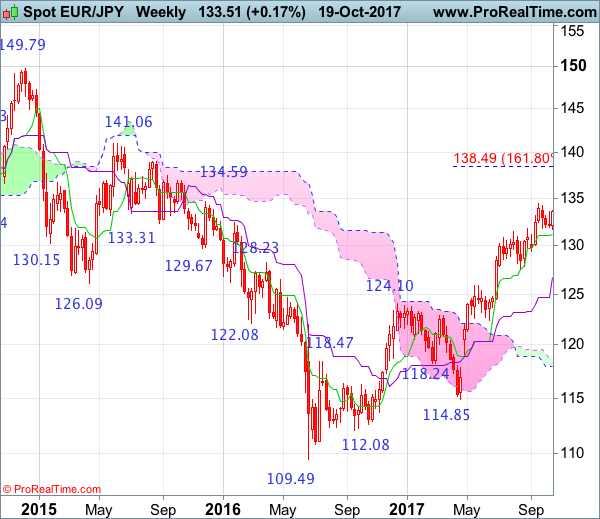

Weekly

• Last Candlesticks pattern: Window

• Time of formation: 24 April 2017

• Trend bias: Up

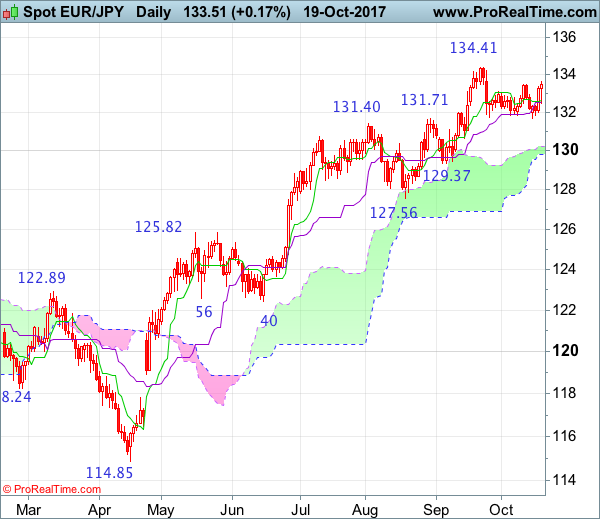

Daily

• Last Candlesticks pattern: Hammer

• Time of formation: 18 May 2017

• Trend bias: Up

EUR/JPY – 133.66

As the single currency found renewed buying interest at 131.66 earlier this week and has staged a strong rebound above previous resistance at 133.50, signaling the pullback from 134.41 (last month’s high) has ended and bring further gain to 134.00, then retest of said resistance. Only a break of this level would confirm recent upmove has resumed for further gain to 135.00, however, near term overbought condition should limit upside to 136.00-10 and reckon 136.90-00 would hold from here, price should falter well below 138.45-50 (1.618 times extension of 109.49-124.10 measuring from 114.85), risk from there has increased for a much-needed correction to take place later.

On the downside, whilst pullback to 132.65-70 cannot be ruled out, reckon the Kijun-Sen (now at 132.52) would hold and bring another rise later. Below 132.00 would risk test of said support at 131.66 but only break there would signal a temporary top has been formed at 134.41 bring retracement of recent upmove to 131.00, then previous support at 130.62, having said that, reckon psychological level at 130.00 would limit downside and price should stay well above another previous support at 129.37, bring rebound later.

Recommendation: Buy at 132.70 for 134.70 with stop below 131.70.

On the weekly chart, as euro found renewed buying interest at 131.66 this week and has staged a rebound, a white candlestick looks set to be formed, hence consolidation with upside bias is seen for gain to 134.00 but break of recent high at 134.41 is needed to confirm recent upmove from 109.49 (2016 low) has resumed and extend gain to 135.00, then 136.00-10, however, reckon upside would be limited and 136.95-00 should hold, price should fatter below 138.45-50 (1.618 times extension of 109.49-124.10 measuring from 114.85), bring retreat later.

On the downside, expect pullback to be limited to 132.60-70 and bring another rise. Only below said support at 131.66 would bring test of the Tenkan-Sen (now at 131.13) but a drop below this level is needed to suggest a temporary top has possibly been formed at 134.41, bring weakness to 129.95-00, however, only a break below 129.37 support would add credence to this view and signal retracement of recent upmove has commenced, hence further weakness to 128.90-00, then towards 128.00-10 would follow but previous support at 127.56 should remain intact.