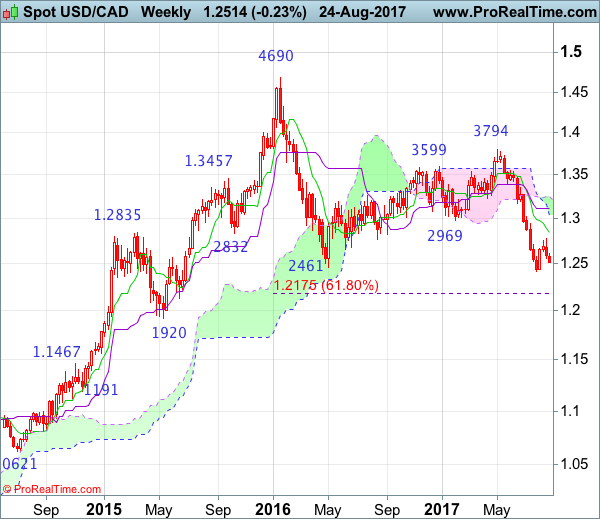

Weekly

• Last Candlesticks pattern: Shooting doji

• Time of formation: 01 May 2017

• Trend bias: Sideways

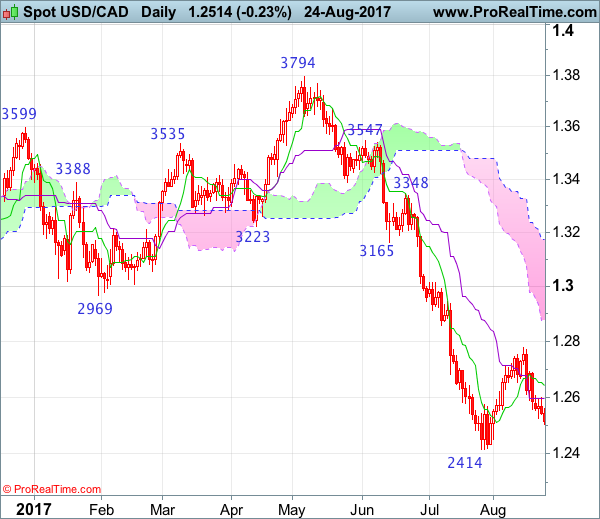

Daily

• Last Candlesticks pattern: Bearish engulfing

• Time of formation: 5 May 2017

• Trend bias: Down

USD/CAD – 1.2536

As the retreat from 1.2778 has kept the greenback under pressure, suggesting the correction from 1.2414 has possibly ended and consolidation with mild downside bias remains for further weakness to 1.2450-55, however, a daily close below there is needed to add credence to signal view and signal recent decline has resumed for retest of 1.2414. Looking ahead, once this support is penetrated, this would confirm resumption of early downtrend to 1.2350-60 and later towards 1.2300 but price should stay well above 1.2240-50, risk from there has increased for a rebound to take place later.

On the upside, whilst recovery to 1.2550-60 cannot be ruled out, reckon the Tenkan-Sen (now at 1.2649) would limit upside and bring another decline later. Above 1.2700-10 would defer and risk another bounce towards said resistance at 1.2778, having said that, only break of this level would abort and risk a stronger rebound to 1.2810-20 but price should falter below previous support at 1.2859 (now resistance) and bring another decline later. Looking ahead, only a sustained breach above this level would signal a temporary low is formed instead, bring retracement of recent decline to the lower Kumo (now at 1.2875), then 1.2900-05 but price should falter well below resistance at 1.3015, bring another selloff later.

Recommendation: Sell at 1.2640 for 1.2440 with stop above 1.2740.

On the weekly chart, as the greenback met resistance at 1.2778 and has retreated, suggesting the rebound from 1.2414 has possibly ended there and retest of said support cannot be ruled out, however, break there is needed to confirm the selloff from 1.4690 top has resumed and extend weakness to 1.2300-10 but oversold condition should prevent sharp fall below 1.2240-50 and price should stay above 1.2175 (61.8% Fibonacci retracement of 1.0621-1.4690), risk from there is seen for another corrective rebound to take place later.

On the upside, whilst minor recovery to 1.2640-50 cannot be ruled out, price should falter below 1.2700-10 and bring another decline later. A break of said resistance at 1.2778 would prolong consolidation above 1.2414 and risk a stronger corrective bounce to 1.2805-10 resistance, then test of previous support at 1.2859 (now resistance), above there would suggest a temporary low has been formed, bring a stronger rebound to 1.2900, then towards resistance at 1.2944 but upside should be limited to psychological level at 1.3000 and price should falter below the Kijun-Sen (now at 1.3104), bring another selloff in late Q3.