Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 7 Mar 2017

• Trend bias: Sideways

Daily

• Last Candlesticks pattern: Morning star

• Time of formation: 9 May 2017

• Trend bias: Near term up

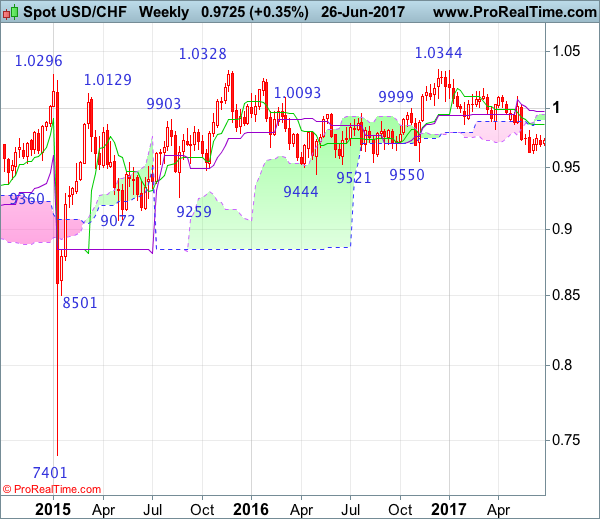

USD/CHF – 0.9700

Although the greenback retreated after meeting resistance at 0.9771 earlier this month, below 0.9641 support is needed to signal the rebound from 0.9613 has ended there, bring retest of this level, break there would confirm recent decline from 1.0344 top (2016 high) has resumed and may extend further weakness to support at 0.9550, then towards psychological support at 0.9500, having said that, near term oversold condition should prevent sharp fall below latter level and risk from there has increased for a rebound later.

On the upside, if said support at 0.9641 continues to hold, then further consolidation would take place and another bounce to 0.9771 cannot be ruled out, however, reckon upside would be limited to indicated resistance at 0.9808, bring another decline. A daily close above 0.9859 (previous support now resistance) would defer and suggest a temporary low has been formed instead, bring a stronger rebound to the lower Kumo (now at 0.9896) and then 0.9950 but price should falter below 1.0000 and bring another selloff.

Recommendation: Sell at 0.9805 for 0.9605 with stop above 0.9905

On the weekly chart, as the greenback has remained under pressure, suggesting bearishness remains for recent decline from 1.0344 to resume after consolidation, expect recovery to be limited to resistance at 0.9808 and the Tenkan-Sen (now at 0.9857) should hold, bring another decline later. Below support at 0.9613 would confirm the aforesaid decline has resumed and may extend weakness for retracement of early upmove towards previous support at 0.9550 but reckon downside would be limited to 0.9500 and another previous support at 0.9444 should remain intact.

On the upside, although initial recovery to 0.9770-75 cannot be ruled out, reckon resistance at 0.9808 would limit upside and bring another decline. A weekly close above the Tenkan-Sen (now at 0.9857) would defer and risk a stronger rebound to 0.9940-50 but 1.0007 (previous resistance) should limit upside and price should falter well below 1.0100, bring another selloff later. Above 1.0100 would signal low is formed instead and suggest the aforesaid decline from 1.0344 has ended, bring test of 1.0171 resistance next.