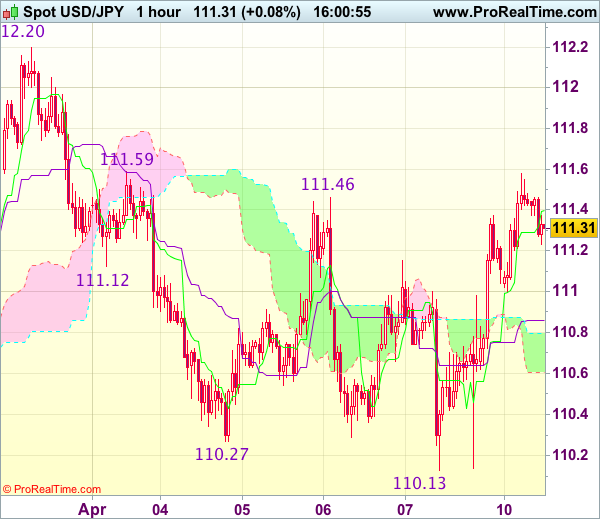

USD/JPY – 111.28

Most recent candlesticks pattern : N/A

Trend : Near term down

Tenkan-Sen level : 111.40

Kijun-Sen level : 110.86

Ichimoku cloud top : 110.80

Ichimoku cloud bottom : 110.60

New strategy :

Buy at 110.90, Target: 111.90, Stop: 110.55

Position : –

Target : –

Stop : –

Although the greenback fell to as low as 110.13 late last week, as dollar has staged a strong rebound after holding above indicated support at 110.11, retaining our view that further consolidation above this level would be seen and mild upside bias is for test of 111.59 resistance, a break there would signal the fall from 112.20 has ended, then a stronger rebound to 111.90-00 would follow but said resistance at 112.20 should hold and choppy trading within 110.11-112.20 would continue.

In view of this, we are looking to buy dollar on dips but one should exit on such rebound. Below the lower Kumo (now at 110.60) would signal an intra-day top is formed instead, risk weakness to 110.40 but only break of said support at 110.11-13 would confirm medium term decline has resumed for further subsequent fall to 109.80-85 (1.618 times projection of 112.20-111.12 measuring from 111.59) but price should hold above 109.50-55 (100% projection of 112.20-110.27 measuring from 111.46).