EUR/USD – 1.1868

Most recent candlesticks pattern : N/A

Trend : Near term up

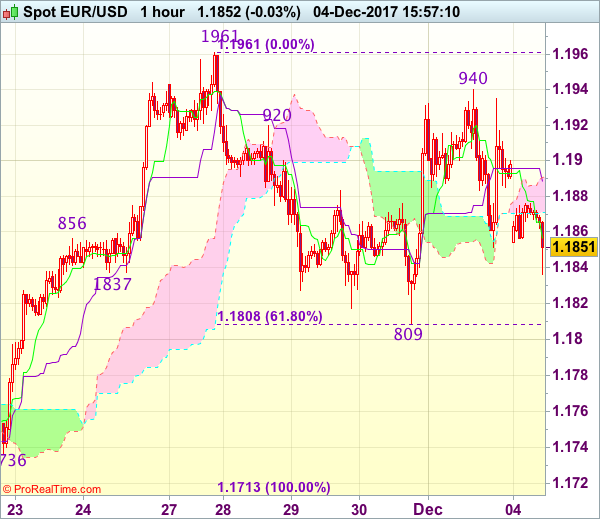

Tenkan-Sen level : 1.1856

Kijun-Sen level : 1.1888

Ichimoku cloud top : 1.1891

Ichimoku cloud bottom : 1.1871

Original strategy :

Bought at 1.1865, stopped at 1.1855

Position : – Long at 1.1865

Target : –

Stop : – 1.1855

New strategy :

Sell at 1.1915, Target: 1.1815, Stop: 1.1950

Position : –

Target : –

Stop : –

As the single currency ran into resistance at 1.1940 on Friday and has retreated, suggesting further consolidation below resistance at 1.1961 (last week’s high) would be seen and weakness towards support at 1.1808-09 (61.8% Fibonacci retracement of 1.1713-1.1961 and previous support), however, break there is needed to retain bearishness and extend weakness to 1.1770 and possibly to support at 1.1736 but price should stay above previous key support at 1.1713.

In view of this, we are looking to sell euro on recovery as 1.1910-20 should limit upside and bring another decline. Above said Friday’s high at 1.1940 would revive bullishness, bring retest of 1.1961, break there would confirm early upmove has resumed for headway to 1.1990-00 which is likely to hold from here.