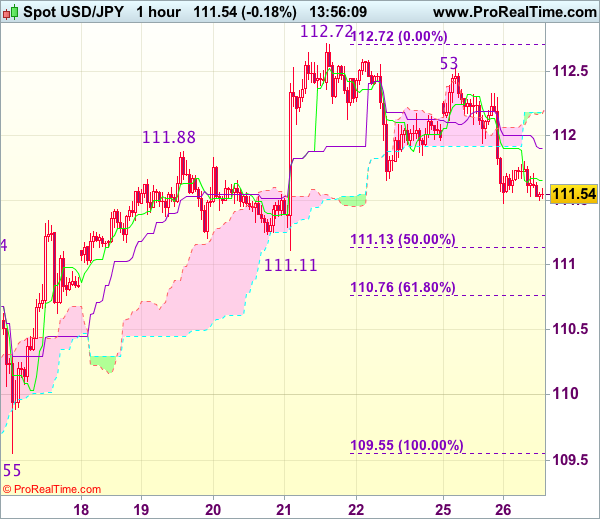

USD/JPY – 111.55

Most recent candlesticks pattern : N/A

Trend : Up

Tenkan-Sen level : 111.65

Kijun-Sen level : 111.90

Ichimoku cloud top : 112.19

Ichimoku cloud bottom : 112.18

Original strategy :

Bought at 111.70, stopped profit at 111.90

Position : – Long at 111.70

Target : –

Stop : – 111.90

New strategy :

Stand aside

Position : –

Target : –

Stop : –

The greenback met renewed selling interest at 112.53 yesterday and has slipped again, suggesting a temporary top has possibly been formed at 112.72 and downside risk remains for weakness towards 111.11-13 (previous support and 50% Fibonacci retracement of 109.55-112.72), however, break there is needed to add credence to this view, bring retracement of recent rise towards 110.75-80 (61.8% Fibonacci retracement) but reckon 110.60-65 would hold on first testing.

On the upside, whilst recovery to the Kijun-Sen (now at 111.90) cannot be ruled out, reckon the upper Kumo (now at 112.23) would limit upside and said resistance at 112.53 should hold, bring another decline later. Only a break of 112.53 resistance would revive bullishness and bring retest of 112.72 (last week’s high), break there would extend recent upmove to 112.90-00, then towards 113.25-30 (1.236 times projection of 107.32-111.04 measuring from 109.55), having said that, previous chart resistance at 113.58 would remain intact.