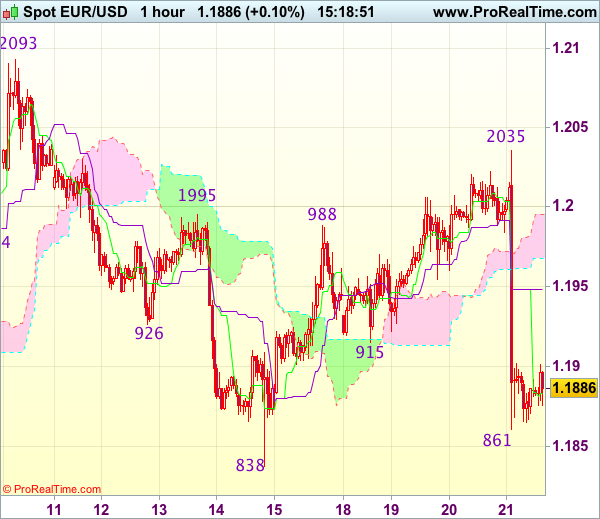

EUR/USD – 1.1894

Most recent candlesticks pattern : N/A

Trend : Sideways

Tenkan-Sen level : 1.1883

Kijun-Sen level : 1.1948

Ichimoku cloud top : 1.1995

Ichimoku cloud bottom : 1.1968

Original strategy :

Bought at 1.1970, stopped at 1.1950

Position : – Long at 1.1970

Target : –

Stop : – 1.1950

New strategy :

Sell at 1.1950, Target: 1.1850, Stop: 1.1985

Position : –

Target : –

Stop : –

Although the single currency rose to as high as 1.2035 in late NY, euro ran into strong selling pressure there and has dropped sharply after Fed, suggesting early rebound from 1.1838 has ended there and downside bias is seen for retest of said support, break there would signal another leg of corrective decline from 1.2093 top is underway and extend weakness to 1.1800-05 but near term oversold condition would limit downside to 1.1770 and reckon 1.1750 would hold.

In view of this, we are looking to sell euro on recovery as the Kijun-Sen (now at 1.1948) should limit upside and bring another decline later. Above the lower Kumo (now at 1.1968) would defer and risk a stronger rebound to the upper Kumo (now at 1.1995) but said resistance at 1.2035 should remain intact.