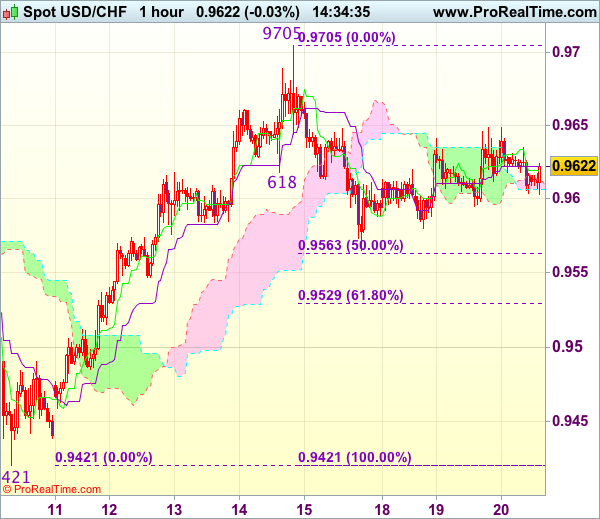

USD/CHF – 0.9619

Most recent candlesticks pattern : N/A

Trend : Near term up

Tenkan-Sen level : 0.9619

Kijun-Sen level : 0.9622

Ichimoku cloud top : 0.9612

Ichimoku cloud bottom : 0.9607

Original strategy :

Sold at 0.9625, Target: 0.9525, Stop: 0.9660

Position : – Short at 0.9625

Target : – 0.9525

Stop : – 0.9660

New strategy :

Hold short entered at 0.9625, Target: 0.9525, Stop: 0.9650

Position : – Short at 0.9625

Target : – 0.9525

Stop : – 0.9650

The greenback has continued meeting resistance at 0.9649 and has remained locked within familiar range, retaining our view that further consolidation would take place and as long as said resistance at 0.9649 holds, mild downside bias remains for another fall towards 0.9563-65 (50% Fibonacci retracement of 0.9421-0.9705 and Friday’s low), break there would add credence to our view that top has been formed at 0.9705, bring further weakness to 0.9525-30 (61.8% Fibonacci retracement), however, downside should be limited to 0.9500 and 0.9480-85 should hold from here.

In view of this, we are holding on to our short position entered at 0.9625. Above 0.9649 would defer and risk rebound to 0.9675-80, break there would signal the pullback from 0.9705 has ended, bring retest of this level, a breach of this last week’s high would extend recent rise from 0.9421 to 0.9740-50 later.