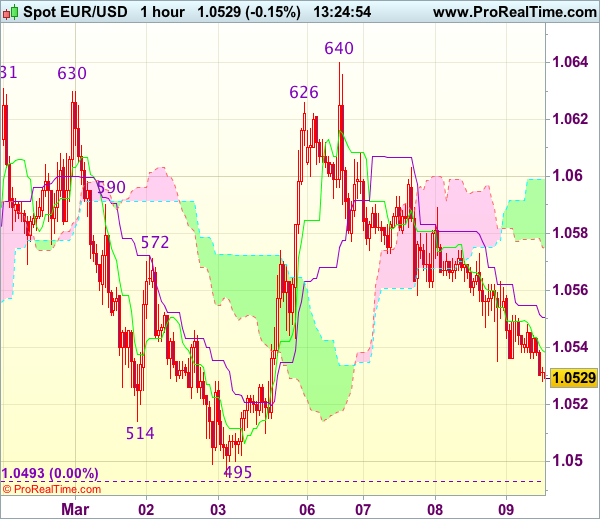

EUR/USD – 1.0530

Most recent candlesticks pattern : N/A

Trend : Sideways

Tenkan-Sen level : 1.0538

Kijun-Sen level : 1.0551

Ichimoku cloud top : 1.0599

Ichimoku cloud bottom : 1.0575

Original strategy :

Buy at 1.0525, Target: 1.0625, Stop: 1.0490

Position : –

Target : –

Stop : –

New strategy :

Buy at 1.0515, Target: 1.0625, Stop: 1.0485

Position : –

Target : –

Stop : –

Although the single currency has remained weak and near term downside risk remains for the retreat from 1.0640 to extend marginal weakness from here, reckon downside would be limited to 1.0515-20 and bring another rebound later, above 1.0575 would suggest an intra-day low is formed, bring recovery to 1.0600-05 and possibly 1.0625, however, reckon said resistance at 1.0640 would hold. Only a break above 1.0640 would extend the erratic rise from 1.0493 low for retracement of early decline to 1.0660-65 (50% Fibonacci retracement of 1.0829-1.0493) and possibly towards resistance at 1.0680 but price should falter well below 1.0700-05 (61.8% Fibonacci retracement).

In view of this, we are looking to buy euro on dips. Below 1.0510 would risk retest of 1.0493 but only break there would shift risk back to the downside and signal recent decline from 1.0829 has resumed for further selloff to 1.0470 and then towards previous support at 1.0454.