EUR/USD – 1.1880

Most recent candlesticks pattern : N/A

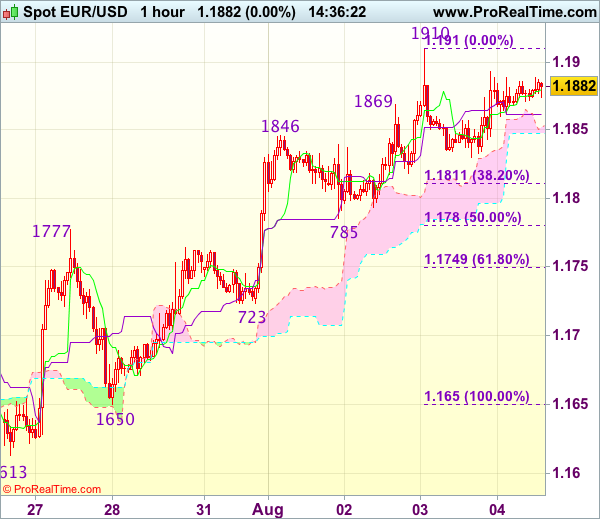

Trend : Near term up

Tenkan-Sen level : 1.1880

Kijun-Sen level : 1.1862

Ichimoku cloud top : 1.1852

Ichimoku cloud bottom : 1.1848

Original strategy :

Sold at 1.1880, Target: 1.1780, Stop: 1.1915

Position : – Short at 1.1880

Target : – 1.1780

Stop : – 1.1915

New strategy :

Hold short entered at 1.1880, Target: 1.1780, Stop: 1.1915

Position : – Short at 1.1880

Target : – 1.1780

Stop : – 1.1915

Although the single currency has maintained a firm undertone after rebounding from 1.1830 (yesterday’s low), as long as indicated resistance at 1.1910 holds, further consolidation would take place and risk remains for another retreat, below said support at 1.1830 would bring weakness to 1.1810-15, however, break of 1.1780-85 (50% Fibonacci retracement of 1.1650-1.1910 and previous support) is needed to signal top is formed, bring retracement of recent rise to 1.1745-50 (61.8% Fibonacci retracement) but support at 1.1723 would remain intact.

In view of this, we are holding on to our short position entered at 1.1880. Above said resistance at 1.1910 would signal recent upmove is still in progress and may extend headway to 1.1940-50 and possibly towards 1.1970-75 before correction takes place.