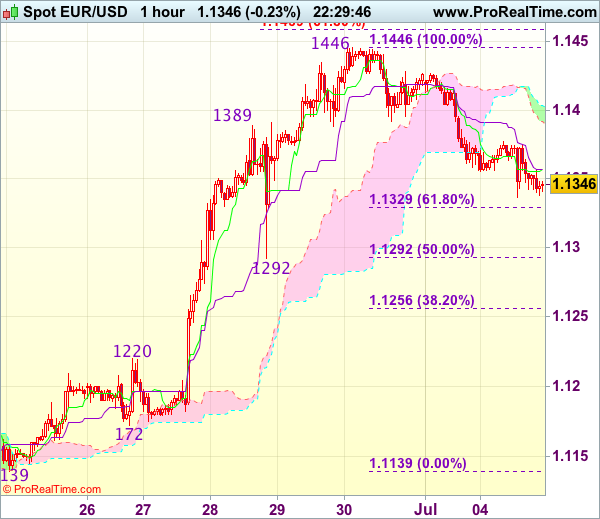

EUR/USD – 1.1345

Most recent candlesticks pattern : N/A

Trend : Near term up

Tenkan-Sen level : 1.1357

Kijun-Sen level : 1.1357

Ichimoku cloud top : 1.1404

Ichimoku cloud bottom : 1.1392

Original strategy :

Buy at 1.1300, Target: 1.1400, Stop: 1.1265

Position : –

Target : –

Stop : –

New strategy :

Buy at 1.1300, Target: 1.1400, Stop: 1.1265

Position : –

Target : –

Stop : –

As euro’s retreat from last week’s high of 1.1446 has kept the single currency under near term pressure, suggesting initial downside risk remains for retracement of recent upmove to 1.1325-30 (38.2% Fibonacci retracement of 1.1139-1.1446), however, reckon support at 1.1292 (as well as 50% Fibonacci retracement) would hold and bring another rise, above 1.1400-10 would bring retest of said resistance at 1.1446, break there would extend recent rise to 1.1455-60 (61.8% projection of 1.1119-1.1389 measuring from 1.1292), then 1.1480.

In view of this, would not chase this rise here and would be prudent to buy euro on pullback as 1.1292 (previous support as well as 50% Fibonacci retracement of 1.1139-1.1446) should limit downside, bring rebound. Below 1.1270 would abort and signal a temporary top is formed, bring correction to 1.1250-55 first.