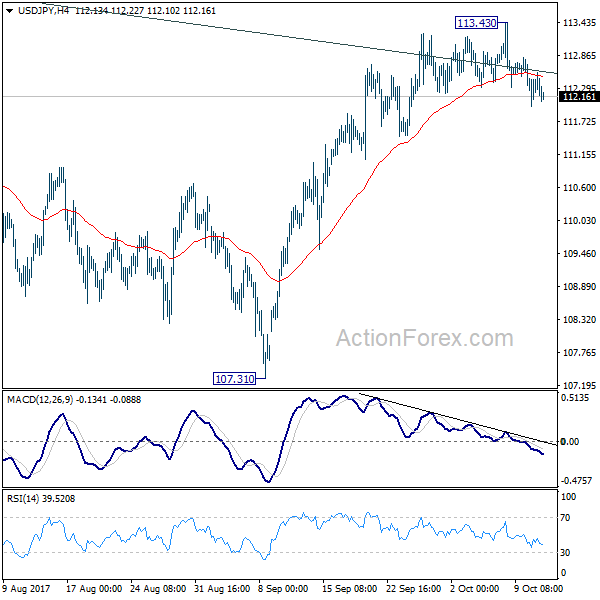

Daily Pivots: (S1) 112.01; (P) 112.41; (R1) 112.85; More…

Intraday bias in USD/JPY remains on the downside for the moment. A short term top should be in place at 113.43, on bearish divergence condition in 4 hour MACD. Also, the pair is rejected by medium term channel resistance. Deeper fall would be seen to downside for 55 day EMA (now at 111.32) first. Sustained break there will bring retest of 107.31. For now, risk will stays on the downside as long as 113.43 resistance holds.

In the bigger picture, rise from 98.97 (2016 low) is seen as the second leg of the corrective pattern from 125.85 (2015 high). It’s unclear whether this this second leg has completed at 118.65 or not. But medium term outlook will be mildly bearish as long as 114.49 resistance holds. And, there is prospect of breaking 98.97 ahead. Meanwhile, break of 114.49 will bring retest of 125.85 high. But even in that case, we don’t expect a break there on first attempt.