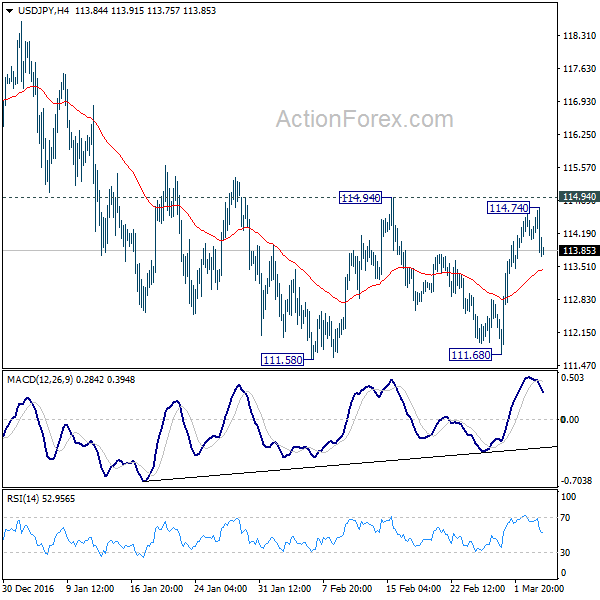

Daily Pivots: (S1) 113.61; (P) 114.18; (R1) 114.56; More…

USD/JPY dips mildly today on broad based rebound in Yen. The rejection from 114.94 resistance argues that the correction from 118.65 is possibly not completed yet. But still, in case of another fall, we’d still expect strong support from 38.2% retracement of 98.97 to 118.65 at 111.13 to contain downside and bring rebound. On the upside, decisive break of 114.94 will indicate that it’s completed with a double bottom pattern (111.58, 111.68). In such case, intraday bias will be turned to the upside for retesting 118.65.

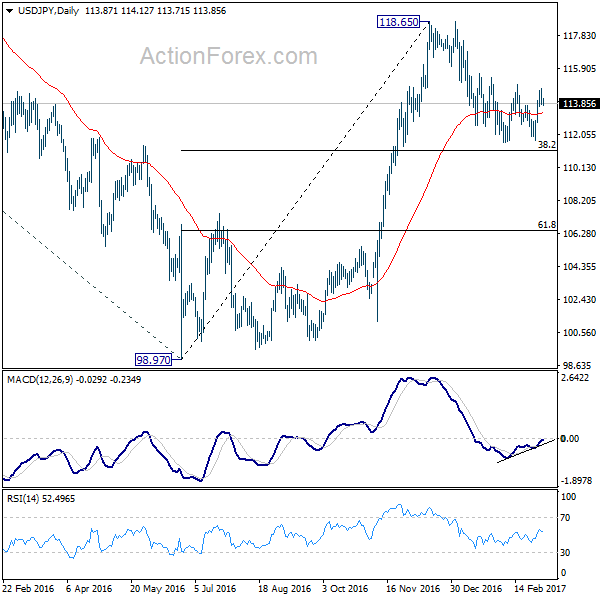

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.