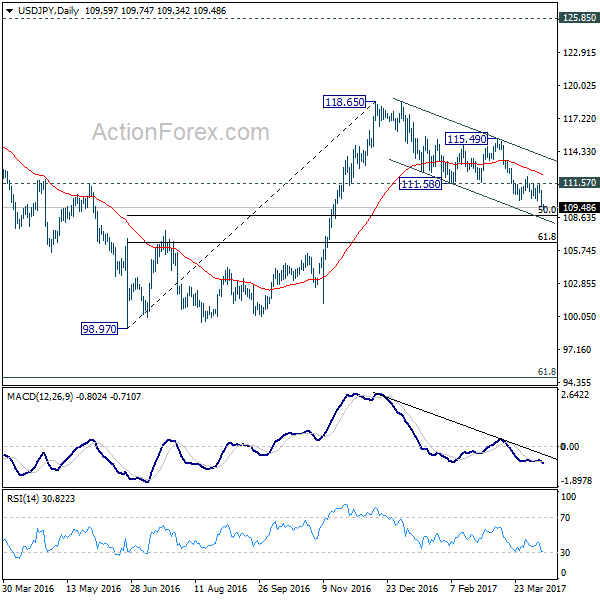

Daily Pivots: (S1) 109.15; (P) 110.04; (R1) 110.49; More….

USD/JPY’s strong break of 110.10 support confirms resumption of near term decline from 118.65. Intraday bias is back on the downside for 50% retracement of 98.97 to 118.65 at 108.81. At this point, there is no clear indication of reversal yet and it’s staying comfortably inside a falling channel. Break of 108.81 will target 61.8% retracement at 106.48 and possibly below. Meanwhile, on the upside, break of 111.57 resistance is needed to be the first sign of reversal. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. Sustained trading below 55 week EMA (now at 111.15) will indicate that the second leg from 98.97 has completed at 118.65. And in that case, USD/JPY would start the third leg down through 98.97 low to 61.8% retracement of 75.56 to 125.85 at 94.77. On the upside, break of 115.49 resistance should resume the rise from 98.97 for a test on 125.85 high.