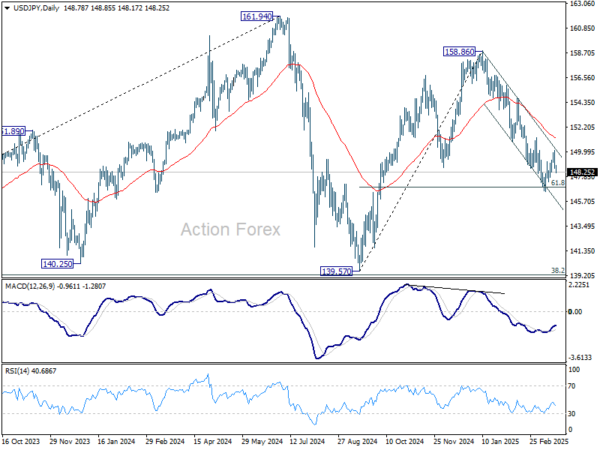

Daily Pivots: (S1) 148.15; (P) 149.15; (R1) 149.69; More…

USD/JPY’s currently steep decline suggests rejection by near term falling channel resistance. Immediate focus is now on 148.22 minor support. Firm break there will indicate that corrective rebound from 146.52 has completed and bring retest of this low first. Sustained trading below 61.8% retracement of 139.57 to 158.86 at 146.32 will resume the fall from 158.86 to 139.57 support. In case of another recovery, upside should be limited by 150.92 support turned resistance.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.