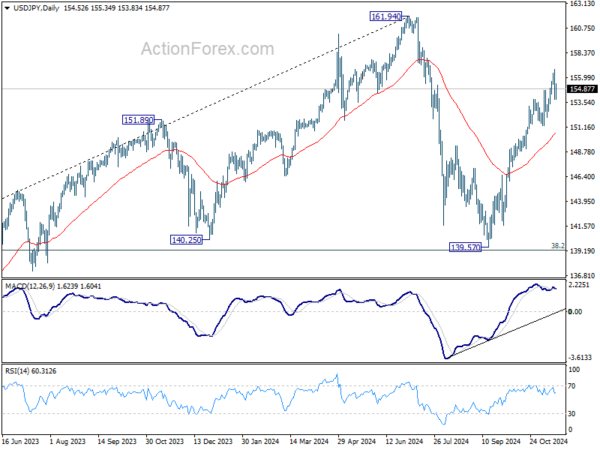

Daily Pivots: (S1) 153.18; (P) 154.97; (R1) 156.07; More…

Intraday bias in USD/JPY remains neutral for the moment. Another rise is in favor as long as 153.87 resistance turned support holds. Break of 156.74 will resume the rally from 139.57 towards 161.91 high. However, firm break of 153.87 and the near term rising channel would confirm short term topping. In this case, intraday bias will turn back to the downside for 151.27 support, or even further to 38.2% retracement of 139.57 to 156.74 at 150.18.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.