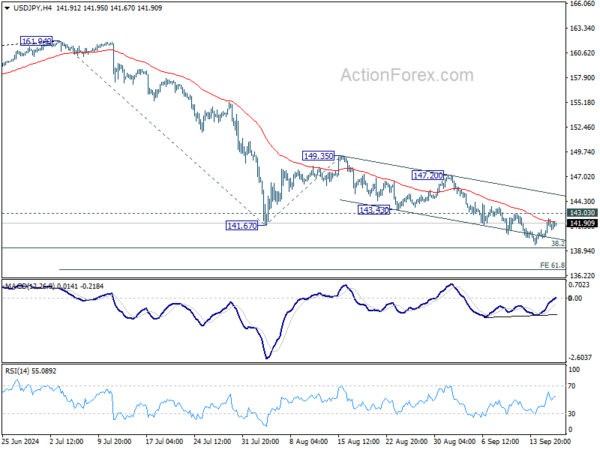

Daily Pivots: (S1) 141.01; (P) 141.74; (R1) 143.16; More…

Outlook in USD/JPY remains unchanged and intraday bias stays neutral. Considering bullish convergence condition in 4H MACD, break of 143.03 resistance will indicate short term bottoming and turn bias back to the upside for rebound towards 147.20. However, decisive break of 139.26 fibonacci level would carry larger bearish implications, and target 61.8% projection of 161.94 to 141.67 from 149.35 at 136.82 next.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Strong support could be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to contain downside, at least on first attempt. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.