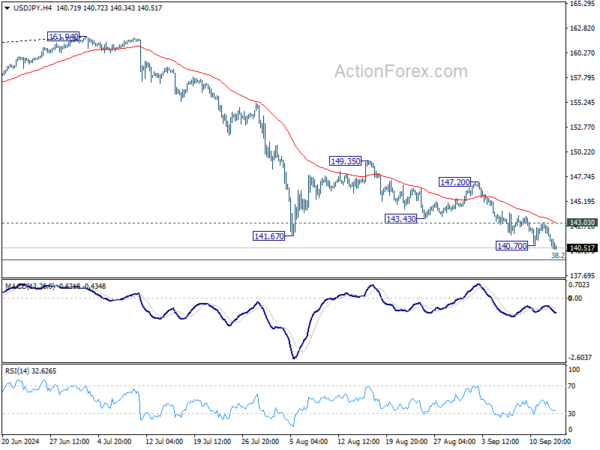

Daily Pivots: (S1) 141.35; (P) 142.20; (R1) 142.66; More…

USD/JPY’s decline resumed by breaking through 140.70 and intraday bias is back on the downside. Further fall should be seen to 139.26 fibonacci level. Decisive break there would carry larger bearish implications. On the upside, above 143.03 minor resistance will turn intraday bias neutral again first. But outlook will stay bearish as long as 147.20 resistance holds.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 55 W EMA (now at 148.93) holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.