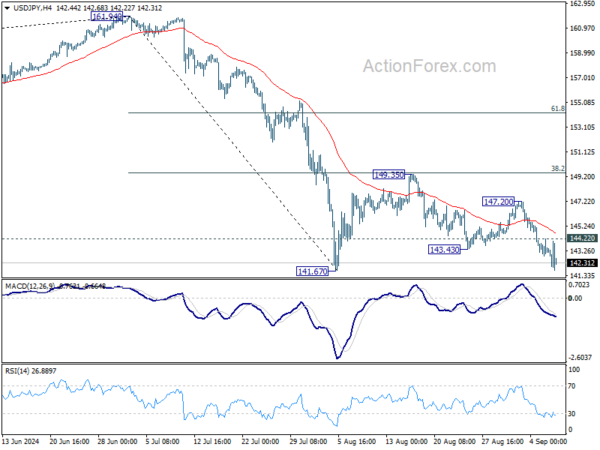

USD/JPY’s fall from 149.35 resumed last week by breaking through 143.43 temporary low. Initial bias stays on the downside this week for 141.67 support. Firm break of 141.67 support will resume whole decline from 161.95 high, for 140.25 support next. On the upside, above 144.22 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 147.20 resistance holds, in case of recovery.

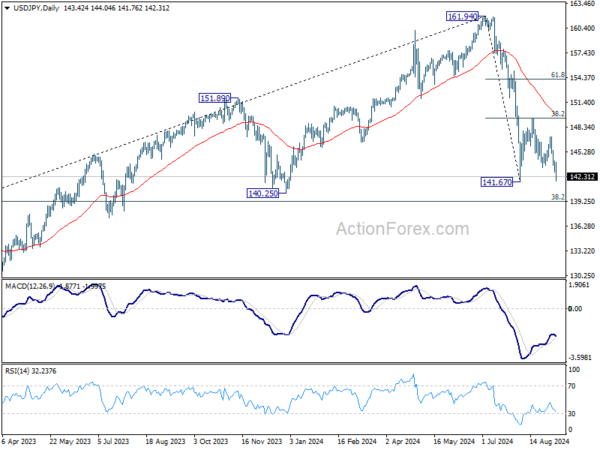

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.24) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

In the long term picture, it’s still early to conclude that up trend from 75.56 (2011 low) has completed. However, a medium term corrective phase should have commenced, with risk of deep correction towards 55 M EMA (now at 133.19).