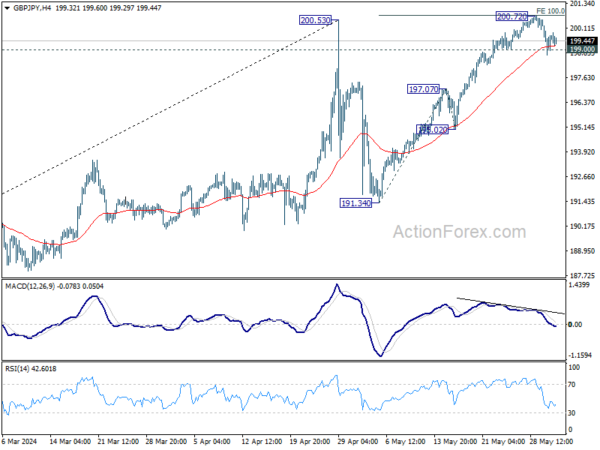

Daily Pivots: (S1) 198.80; (P)199.63; (R1) 200.50; More…

Intraday bias in USD/JPY remains neutral at this point. Firm break of 199.00 support will suggest short term topping, on bearish divergence condition in 4H MACD. Rise from 191.34, as the second leg of the corrective pattern from 200.53, might have completed too. Deeper fall should then be seen to 197.07 resistance turned support next.

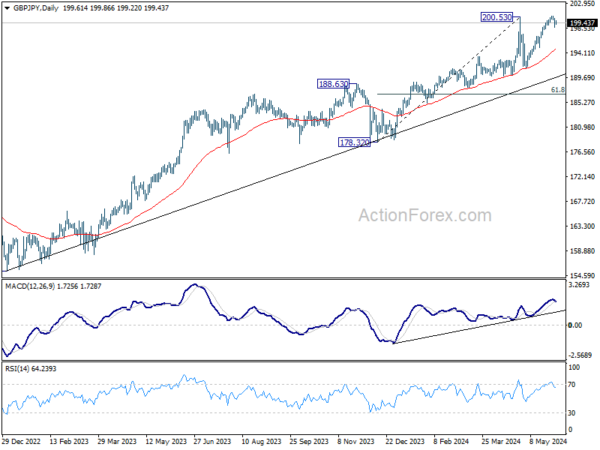

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 185.01) holds, price actions from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.