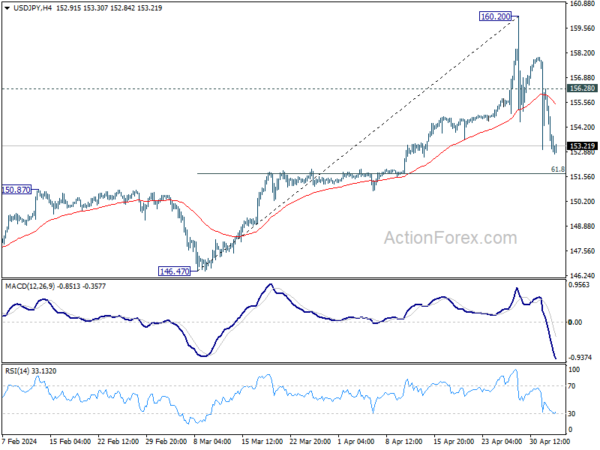

Daily Pivots: (S1) 152.37; (P) 154.33; (R1) 155.60; More…

Intraday bias in USD/JPY remains on the downside as fall from 160.20 is in progress. As a correction to rise from 146.47, deeper decline would be seen to 55 D EMA (now at 152.25), and possibly further to 61.8% retracement of 146.47 to 160.20 at 151.71. But strong support should be seen from 150.87 resistance turned support to bring rebound. On the upside, above 156.28 will argue that the pull back has completed and the range is set for sideway consolidations.

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 100% projection of 127.20 to 151.89 from 140.25 at 164.94. Outlook will remain bullish as long as 150.87 resistance turned support holds, even in case of deep pullback.